kremlin2000.ru

Gainers & Losers

Best Business Bank Account Reviews

Chase is the largest bank in the U.S. providing a wide variety of financial products for small businesses including checking accounts, loans, business savings. Find the Right Fit for Your Business Needs ; Ready to open an account? Schedule an Appointment ; Available · Ready to open an account? ; Available. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks and mortar locations as well as a. A business checking account might be the best option for small businesses. For complete details, please review the Additional Banking Services and Fees for. Business banking designed for small business owners and the self-employed. Simplify taxes, bookkeeping and more. No hidden fees or monthly minimums. Great banking experience. It's easy to navigate and complete basic and complex banking needs. I would happily recommend. Verified, collected by Starling Bank. Chase Business Complete Banking℠. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks. Given that Bluevine is the only provider that offers decent interest rates and charges no monthly fees, it is one of the best business bank accounts for an LLC. Bank of America's Business Advantage Relationship Banking account erases most fees, making it a good fit for busy small businesses. Pros. Chase is the largest bank in the U.S. providing a wide variety of financial products for small businesses including checking accounts, loans, business savings. Find the Right Fit for Your Business Needs ; Ready to open an account? Schedule an Appointment ; Available · Ready to open an account? ; Available. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks and mortar locations as well as a. A business checking account might be the best option for small businesses. For complete details, please review the Additional Banking Services and Fees for. Business banking designed for small business owners and the self-employed. Simplify taxes, bookkeeping and more. No hidden fees or monthly minimums. Great banking experience. It's easy to navigate and complete basic and complex banking needs. I would happily recommend. Verified, collected by Starling Bank. Chase Business Complete Banking℠. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks. Given that Bluevine is the only provider that offers decent interest rates and charges no monthly fees, it is one of the best business bank accounts for an LLC. Bank of America's Business Advantage Relationship Banking account erases most fees, making it a good fit for busy small businesses. Pros.

Business Advantage Fundamentals Banking · Maintain a $5, combined average monthly balance across your linked Bank of America accounts · Use your Bank of. For all these reasons and more, Monito recommends Novo's free business checking account to any US-based small business owner, entrepreneur, or freelancer. Chase has more than branches in the US, making it a great choice for business owners who want the convenience of bricks and mortar locations as well as a. Which bank is best for a business account? Mercury is our top choice for banking services for startups. The fintech company boasts no monthly fees and a. Best small business banks and business accounts: Wise, Capital One, Chase, Lili, Relay, Truist, Shopify, Square, SoFi Bank, U.S. Bank, Revolut, PayPal. What are free business checking account options? · Bluevine offers a business checking account with no monthly fees and unlimited transactions. · Novo offers a. It's a good option for account holders who can either maintain a minimum balance or pay a monthly service fee to waive the requirements. However, it's not a. For freelancers, Lili is the best business checking account option, because it's designed specifically for the unique needs of solo businesses. One of the more. Business bank accounts · Wise Business vs Personal: What's the difference? · Can I open a USAA business account? (Best USAA alternatives) · How to delete your. The 15 best business bank accounts · Tide Free Business Account · Starling Bank Business Current Account · Revolut Business Basic Account · ANNA Money Pay as You Go. Business Bank Account Reviews · Novo Bank · Bluevine · Brex Business Account · Square Business Banking · QuickBooks Checking · American Express Business Checking. Chase: Business Complete Checking®; Bluevine: Business Checking; Bank of America: Bank of America Business Advantage Fundamentals™ Banking; Citibank. The best business bank accounts · Tide Business Account · Cynergy Bank · The Co-operative Bank · Starling Bank Business Account · Virgin Money M account for business. Unlock faster global payments, industry-leading yield, and 20x FDIC protection from day 1. This is business banking, made better. Open an account in How to Open a Business Checking Account ; 1. CIT Bank - Platinum Savings · %. Min. Balance to Earn APY. $5, ; 2. CloudBank 24/7 High Yield Savings Account. How many stars would you give Small Business Bank? Join the people who've already contributed. Your experience matters. Initiate Business Checking · No transactions fee for the first transactionsFootnote 1 per fee period. After , it's $ each transaction. · No cash deposit. Find the best fit for your business banking accounts with Navy Federal Credit Union. Chase and Bank of America are arguably the best choice for a small business. They both are considered too big too fail, offer new account. Compare interest rates and overdraft limits at a glance. Find a business account. /5. , reviews on How to choose the best business bank account? Just.

How To Get My Nft Noticed

Choosing a trustworthy marketplace is essential, as you'll have to connect your wallet to buy or sell NFTs. If you're using the Ethereum blockchain, you might. How do I get my NFT noticed? Free Ways of Promotion: Add your drop to the NFT Calendar. Use your social media channels. Create an eye-catching teaser of your. We've compiled a guide on how to market your NFTs and become a visible artist in the crowd of others. Keep reading and find out how to properly present your. It is more about highlighting your works so the audience is able to see your NFT art. Your artwork or an NFT drop can be noticed on the surface of the. Posting new NFTs regularly · Promoting these NFTs on social Media. Twitter, Reddit, Instagram, Tiktok and Discord. · Making a website with a. Connected to estimated market cap is an NFT project's community. The number of unique holders of a certain NFT can tell potential investors a lot about its. OpenSea and Manifold are two of the best ways to create/mint your NFTs. Just keep in mind that minting is fairly easy, but getting noticed and actually. NFTs are perfect for studying marketing. Most NFTs have no inherent physical value. Most do not 'do' anything in the physical world (though some do have a. How Do I Market My NFTs? · 1- Add Your Artwork to the NFT Calendar · 2- Use Your Social Media Channels · 3- Start a thread on Reddit/Bitcointalk. Choosing a trustworthy marketplace is essential, as you'll have to connect your wallet to buy or sell NFTs. If you're using the Ethereum blockchain, you might. How do I get my NFT noticed? Free Ways of Promotion: Add your drop to the NFT Calendar. Use your social media channels. Create an eye-catching teaser of your. We've compiled a guide on how to market your NFTs and become a visible artist in the crowd of others. Keep reading and find out how to properly present your. It is more about highlighting your works so the audience is able to see your NFT art. Your artwork or an NFT drop can be noticed on the surface of the. Posting new NFTs regularly · Promoting these NFTs on social Media. Twitter, Reddit, Instagram, Tiktok and Discord. · Making a website with a. Connected to estimated market cap is an NFT project's community. The number of unique holders of a certain NFT can tell potential investors a lot about its. OpenSea and Manifold are two of the best ways to create/mint your NFTs. Just keep in mind that minting is fairly easy, but getting noticed and actually. NFTs are perfect for studying marketing. Most NFTs have no inherent physical value. Most do not 'do' anything in the physical world (though some do have a. How Do I Market My NFTs? · 1- Add Your Artwork to the NFT Calendar · 2- Use Your Social Media Channels · 3- Start a thread on Reddit/Bitcointalk.

Use your social media channels Social media marketing is a great way to get your name out there. If it's an NFT collection of multiple NFTs. It is more about highlighting your works so the audience is able to see your NFT art. Your artwork or an NFT drop can be noticed on the surface of the. Through our past experience, we have learnt the best strategies to effectively sell NFTs maximizing the results while optimizing two key resources: time and. how can I get my work noticed on NFT markets (Mintable, Rarible, OpenSea, etc.) if I have very little following on social media sites? 3. Schedule your NFT drop. · Schedule it for a time and date which suits your target audience. · Ensure there is enough time between announcing the drop and the. We've compiled a guide on how to market your NFTs and become a visible artist in the crowd of others. Keep reading and find out how to properly present your. Auditing markets for unauthorized use of your work. Send takedown notices if needed. · Filing disputes on NFT marketplaces when your copyright ownership is. Get Noticed and Become a Recognized Artist: No one will recognize you if they have never seen your art or even know that you exist. When you. d) How might the potential for the owner of an NFT to receive additional rights or assets (such as additional NFTs) due to ownership of the NFT. (even in the. Foundation also has a strong community of artists and collectors, which can help get your work noticed. Rarible. Rarible is a decentralized NFT marketplace that. NFT promotion · Step 1: Build your community · Step 2: Leverage the power of social media · Step 3: Get featured on relevant NFT platforms · Step 4: Collaborate. One of the ways you can get your items seen is through Pro-services. Pro-services are the perfect way to leverage the community on all of Mintable's platforms. Listing your project on specialized NFT Calendar websites and social media channels allows projects to tap into a like-minded pool of NFT fans from the get-go. When you list your NFTs, make sure to write clear and interesting descriptions. Use high-quality images to show off your work and add keywords. And We Have The Answers · Build hype for your NFTs, which increases demand · Use higher demand to request higher prices for your token sales · Strengthen your. You may track lots via the tracking feature on the website. This gives you one location to find everything you're interested in, and even place batch bids. To succeed in promoting NFTs on Instagram, consider collaborating with other creators in the same niche or industry. Take advantage of influencer marketing by. Most often, NFT marketplaces or third-parties hosting the infringing content require you fill out a webform to submit your DMCA notice. If you do not receive a. Go to kremlin2000.ru (shown above). In the right-hand corner of the screen, there's a button that reads 'Connect wallet'. Click there, and on the next screen, you. I have been playing around with Solana, deploying NFTs on the devnet. I noticed one thing that when I mint an NFT, it has 2 creators, even.

What Is The Interest Rate On A 15 Year Mortgage

A year mortgage rate specifically is the annual rate of interest you can expect to pay on a mortgage that lasts 15 years. As of August 5, , the average interest rate for a year mortgage is %. But rates vary by lender, so it's important to shop around and compare loans. Year Fixed Rate · Interest% · APR%. A 15 year fixed year mortgage is a loan that will be completely paid off in 15 years assuming all payments are on schedule. As the name implies, this type of. A year Fixed-Rate mortgage is a type of home loan that will take 15 years to pay back and has a fixed interest rate and monthly payments. Additionally, the current national average year fixed mortgage rate remained stable at %. The current national average 5-year ARM mortgage rate is down 1. A year fixed-rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. The current average rate for a year fixed mortgage is %. Find your best rate below. A year mortgage rate specifically is the annual rate of interest you can expect to pay on a mortgage that lasts 15 years. As of August 5, , the average interest rate for a year mortgage is %. But rates vary by lender, so it's important to shop around and compare loans. Year Fixed Rate · Interest% · APR%. A 15 year fixed year mortgage is a loan that will be completely paid off in 15 years assuming all payments are on schedule. As the name implies, this type of. A year Fixed-Rate mortgage is a type of home loan that will take 15 years to pay back and has a fixed interest rate and monthly payments. Additionally, the current national average year fixed mortgage rate remained stable at %. The current national average 5-year ARM mortgage rate is down 1. A year fixed-rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. The current average rate for a year fixed mortgage is %. Find your best rate below.

As of September 2, , the average year fixed mortgage APR is %. Terms Explained. 3.

With a fixed-rate mortgage, you pay the same interest rate throughout the life of your loan. For example, a year mortgage with a 5% fixed rate will have a 5%. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. All fields are required. Purchase Price. $. DOWN PAYMENT ($00K). %. 15 Year Interest Rate A year mortgage will typically have lower interest rates, but a. A year mortgage usually has a slightly lower interest rate where you pay less interest over the life of a loan. Learn more about 15 and year mortgage. As of and , the average year fixed mortgage rate has dropped even further to % and %, respectively. In , the average year fixed. Today's current year, fixed-rate mortgage rates* ; year fixed, %, %. The average APR on a year fixed-rate mortgage fell 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 1 basis point. Here is a rate survey (industry benchmark) showing conventional 15 Year Fixed as of today kremlin2000.ru rates3-year ARM ratesFHA mortgage ratesVA mortgage ratesBest mortgage lenders year fixed rate:APR %. %. Today. %. Over 1y. 5-year ARM rate. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. While others pay a higher rate because they chose a variable interest rate or are new to the market, you will pay only 3%. So a 15 year fixed mortgage means you. Today's Rate on a Year Fixed Mortgage Is % and APR % The interest rate is lower than a year fixed mortgage. However, your monthly payment is. Mortgage Average in the United States (MORTGAGE15US) from to about year, fixed, mortgage, interest rate, interest, rate, and USA. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Looking for a fixed interest rate and a shorter loan term? A. Year FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady A mortgage rate lock keeps your interest rate from changing for a period of time. The average interest rate for a year loan was % as of June 22, Mortgage rates are near record lows right now for all loan types, making it a great. 15 Year Mortgage Rate is at %, compared to % last week and % last year. This is higher than the long term average of %. The 15 Year Mortgage.

Do 401 K Contributions Affect Ira Limits

As long as neither you nor your spouse has a workplace retirement savings account such as a (k), you can contribute the maximum to a traditional IRA no. If you (or your spouse) do not receive contributions or benefits under an employer retirement plan, then you can claim a tax deduction for % of the allowable. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. Counting your IRA contributions as tax deductions depends on the type of IRA you invest in, the retirement plan your employer offers, and your income. Roth IRA. A regular contribution is the annual contribution you're allowed to make to a traditional or Roth IRA: up to $6, for , $7, if you're 50 or older. Also, PSR (k) and plans have the advantage of higher contribution limits than a Roth IRA. How do Roth contributions affect my take-home pay? After-tax. If you participate in plans of different employers, you can treat amounts as catch-up contributions regardless of whether the individual plans permit those. As long as neither you nor your spouse has a workplace retirement savings account such as a (k), you can contribute the maximum to a traditional IRA no. If you (or your spouse) do not receive contributions or benefits under an employer retirement plan, then you can claim a tax deduction for % of the allowable. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. Counting your IRA contributions as tax deductions depends on the type of IRA you invest in, the retirement plan your employer offers, and your income. Roth IRA. A regular contribution is the annual contribution you're allowed to make to a traditional or Roth IRA: up to $6, for , $7, if you're 50 or older. Also, PSR (k) and plans have the advantage of higher contribution limits than a Roth IRA. How do Roth contributions affect my take-home pay? After-tax. If you participate in plans of different employers, you can treat amounts as catch-up contributions regardless of whether the individual plans permit those.

Taxes With K or Traditional IRAs. No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H&R Block. As long as neither you nor your spouse has a workplace retirement savings account such as a (k), you can contribute the maximum to a traditional IRA no. Both plans offer potential tax savings to plan sponsors through tax credits and tax-deductible employer contributions. However, employees are unable to make. have an impact on self-employment income; therefore, the owner-only business owner can make annual solo k contributions regardless of any Roth IRA. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income, regardless of your. Can I contribute to a traditional IRA or Roth IRA. (k) withdrawals are taxed as income, and early withdrawals may incur additional penalties. • Making eligible contributions to a (k) or IRA can potentially. Do not transfer your (k) or Rollover IRA into an RRSP. Minimize amount of the IRA and the amount contributed to the RRSP. In addition, an. If you're a higher-income earner on the edge of qualifying for a Roth IRA contribution, making a (k) contribution could push you under the income limitations. If both you and your spouse are not covered by an employer-sponsored retirement plan, then you can take the full deduction up to the amount of your contribution. The IRS has separate limits for people that are covered by a plan at work. Total contribution will be less than the combined k and roth ira. How do (k) contributions affect my IRA contribution limit? If you're eligible to make (k) contributions—whether you do so or not—that may affect your. But your income and filing status may affect the amounts you are allowed to contribute, in addition to the tax benefits you might see from a dual contribution. The percentage of your annual (k) contributions your employer will match. These contributions are often capped. Please read the definition for "Employer. "Saving in a Roth (k) could be a better way to go if the taxes on a Roth IRA conversion are prohibitive." Higher contribution limits: In , you can stash. Contributing more than your annual limit allows will trigger a 6% penalty tax on the excess amount. The penalty is due when you file your taxes. If you don't. You can contribute to both accounts if you stay below the $19, limit for a Roth (k) and the $6, limit for a Roth IRA. Can I Contribute to a Roth IRA. A (k) Plan is a defined contribution plan that is a cash or deferred arrangement. Employees can elect to defer receiving a portion of their salary which is. The contribution limit for Traditional and Roth IRAs increased to $7, Employees age 50 or older are eligible to contribute an additional $1,, for a total. For , the contribution limits are as follows: You can put up to $6, into an IRA, or $7, if you're 50 or older. For a (k) or (b), you can.

Semi Permanent Hair Color For Bleached Hair

Therefore, semi-permanent color treatments don't have ammonia or bleaching ingredients. This is why they are so much gentler than permanent hair coloring. Even. Choose one of our 40 shades or mix it up to create a colour that is truly unique and individually yours. Semi permanent dyes work best over bleached hair, but depending on the color you want to use would determine if it would work or not. Medium to. Demi-permanent dyes are a step down from permanent and typically last about washes. These can dye your hair shades darker and also can add striking. Yes, demi-permanent hair color is safe to use on previously colored or chemically treated hair. In fact, it's a great way to refresh your current color or. Style: Classic Semi-Permanent Hair Dye · Color: After Midnight · Color Description - Dark Blue Hair Dye · Volume: 4oz / ml · Ingredients: Vegan Friendly, PPD. Original Pink Semi-Permanent Hair Dye Complete Kit with Bleach $ 16 Reviews A box of Splat Hair Color's Purple Desire Hair Dye. Semi-permanent, ammonia-free toners. Balance out bleached blonde hair and create a clean finish or base for adding colour. Fade To Grey Toner. Shop Target for Hair Bleach you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Therefore, semi-permanent color treatments don't have ammonia or bleaching ingredients. This is why they are so much gentler than permanent hair coloring. Even. Choose one of our 40 shades or mix it up to create a colour that is truly unique and individually yours. Semi permanent dyes work best over bleached hair, but depending on the color you want to use would determine if it would work or not. Medium to. Demi-permanent dyes are a step down from permanent and typically last about washes. These can dye your hair shades darker and also can add striking. Yes, demi-permanent hair color is safe to use on previously colored or chemically treated hair. In fact, it's a great way to refresh your current color or. Style: Classic Semi-Permanent Hair Dye · Color: After Midnight · Color Description - Dark Blue Hair Dye · Volume: 4oz / ml · Ingredients: Vegan Friendly, PPD. Original Pink Semi-Permanent Hair Dye Complete Kit with Bleach $ 16 Reviews A box of Splat Hair Color's Purple Desire Hair Dye. Semi-permanent, ammonia-free toners. Balance out bleached blonde hair and create a clean finish or base for adding colour. Fade To Grey Toner. Shop Target for Hair Bleach you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $

Best Semi-Permanent Hair Dye Overall: Redken Shades Eq Gloss Demi-Permanent Color · Best Hydrating Semi-Permanent Hair Dye: Joico Vero K-Pak Intensity Semi-. Bleach London does super cool semi-permanent shades that work well on lighter hair shades and bleached hair. They're ace for a gentle hint. All of our semi-permanent and temporary hair colors are formulated without bleach, lighteners, or harsh chemicals—so you can rock your unicorn style sans. The healthiest way to color your hair! Shop our hydrating semi-permanent Coloring Conditioners made with avocado & coconut oil. % vegan + cruelty free. For light blonde or bleached hair. Colorista allows you to play with hair color without the commitment. Customize your look and transform your style. Temporary hair colouring (fades and washes out, restoring your natural hair colour) does not penetrate your hair or penetrates it less deeply. The colour. Madison Reed Radiant Hair Color Kit. 36 colors · dpHUE Color Dream Demi-Permanent Kit. Sponsored · Clairol Perfect 10 Nice 'n Easy Hair Color. Online only · dpHUE. Semi-permanent hair colors and dyes let you experiment with color without the commitment. Vibrant shades let you express your style without damaging your. Semi-permanent dyes work by layering color directly over the surface of your hair, without changing your natural color. At Splat, we LOVE color, and we're here. Semi-permanent Hair Color in Hair Color(+) · MANIC PANIC Vampire Red Hair Dye - Classic High Voltage - Semi Permanent Deep, Blood Red Hair Color - Vegan, PPD. Change Your Hair Color With Our Range Of Vegan And Cruelty Free Semi-Permanent Hair Dyes. Dyes last between washes for temporary hair color. Semi permanent hair dye applies color to the surface of the hair. This type of dye is often available in naturally-occurring shades because it blends with. Discover Arctic Fox's vibrant, long-lasting semi-permanent hair colors. Vegan, cruelty-free, and specially formulated with added conditioners. The main difference between permanent and semi-permanent hair dye is that permanent color enters the cortex of strands, altering their structure and color. Semi-permanent hair dyes are a significantly less harsh alternative to traditional dyes that won't damage your hair. Semi-permanent Hair Color in Hair Color(+) · MANIC PANIC Vampire Red Hair Dye - Classic High Voltage - Semi Permanent Deep, Blood Red Hair Color - Vegan, PPD. ColorSilk Beautiful Color is the #1 brand in the USA. The ammonia-free hair color delivers % gray coverage and salon-quality color and shine. XMONDO Color by Brad Mondo. Vibrant vegan hair color. Bond-Building Technology for stronger, healthier hair. Hair color is % vegan, cruelty-free. Gentle, semi-permanent hair colour creams. Transform bleached and toned hair into your favourite Super Cool shade! ; Gobby Pink Super Cool Colour. (27). Protein filler is a good idea because your hair will be more porous now you've bleached it, and demi or semi dye will probably be safest to use, depending on.

Twitter Verifier

Verified X Stats. Verification. My experience with verified on X Twitter for two months with the $9 mid-tier level premium. Having a verified. Account age: The account must be at least 30 days old. How to Apply for Twitter Verification. Applying for Twitter verification is a straightforward. Return Twitter's legacy verification and change the verification badge from users with Twitter Blue. How to Get Verified on Twitter: A Simple Guide · Log in to your Twitter account on desktop or mobile and ensure your profile is completely filled out. · Go to. Twitter Verified Organizations. Any organization that purchases a Verified Organizations subscription will receive a gold checkmark and square avatar if they. Twitter Verification is an achievement for brands and content creators, serving as a badge of authenticity and influence in the competitive social media. Did you know Verified Organizations with affiliated accounts receive 2x more reach on Twitter To remain verified on Twitter, individuals can sign up for. Tomorrow, 4/20, we are removing legacy verified checkmarks. To remain verified on Twitter, individuals can sign up for Twitter Blue here. How to Get Verified on Twitter / X: A Simple Guide · Become Eligible for Review First · Request Verification · Show Twitter Some of Your Credibility · Confirm. Verified X Stats. Verification. My experience with verified on X Twitter for two months with the $9 mid-tier level premium. Having a verified. Account age: The account must be at least 30 days old. How to Apply for Twitter Verification. Applying for Twitter verification is a straightforward. Return Twitter's legacy verification and change the verification badge from users with Twitter Blue. How to Get Verified on Twitter: A Simple Guide · Log in to your Twitter account on desktop or mobile and ensure your profile is completely filled out. · Go to. Twitter Verified Organizations. Any organization that purchases a Verified Organizations subscription will receive a gold checkmark and square avatar if they. Twitter Verification is an achievement for brands and content creators, serving as a badge of authenticity and influence in the competitive social media. Did you know Verified Organizations with affiliated accounts receive 2x more reach on Twitter To remain verified on Twitter, individuals can sign up for. Tomorrow, 4/20, we are removing legacy verified checkmarks. To remain verified on Twitter, individuals can sign up for Twitter Blue here. How to Get Verified on Twitter / X: A Simple Guide · Become Eligible for Review First · Request Verification · Show Twitter Some of Your Credibility · Confirm.

Twitter Blue verification controversy This page is currently being merged. After a discussion, consensus to merge this page into Twitter verification was. verified program and removing legacy verified checkmarks. To keep your blue checkmark on Twitter, individuals can sign up for Twitter Blue. For requests to verify individual accounts (that do not represent a company or organization), Twitter requires a copy of an official government-issued photo. A browser extension that brings back Twitter's (X) legacy verification, allows you to customize badges and distinguishes legacy verified users vs Twitter. Twitter: Twitter Verifier uses a 3 step process for linking an Ethereum address to a Twitter account. Users use their Ethereum private key to sign a message. How Many Verified Twitter Accounts Exist? There are roughly , verified Twitter accounts. Naturally, most are going to be brands, influencers, or. Who is eligible for Twitter verification? You must be a notable brand or public figure (musician, artist, influencer, athlete, doctor, investor, etc.) to be. As part of ongoing conversations with social media platforms, NSPRA and CoSN are sharing the following update on how school districts' Twitter accounts can. It is entirely free to become verified on Twitter. Contact Twitter and meet their eligibility conditions, and they will complete your verification request. Once your profile is ready, you can apply for verification through Twitter's request verification form. Make sure to provide any supporting documents or website. How to apply for Twitter verification? · Log in to your Twitter account. · Go to the “Settings and privacy” section. · Select “Account” from the drop-down menu. Look for the blue Verified badge on your Twitter profile. All Verified accounts have the badge next to their display name. How do I know if someone else is. How to get verified on Twitter after getting X Premium? Once you become a subscriber, you don't have to do anything. The platform will begin verifying your. Summary. Verifying your account in the Twitter Blue service is done manually once you have requested and paid for the subscription. Therefore, it is not. When you submit a request to verify an account, Twitter will ask for additional information that can help them evaluate the request. You will be asked to share. The point of Twitter verification is that for certain individuals/organizations it's useful to be able to verify their statements are coming. Introduction · No one believes Musk created the new “verifiction” system—in which Twitter users willing to pay $8 or (for Android and iOS. Twitter. Rather than relying on Twitter to be the sole arbiter of truth for which accounts should be verified, vetted organizations that. twitter verified symbol icons. Vector icons in SVG, PSD, PNG, EPS and ICON FONT.

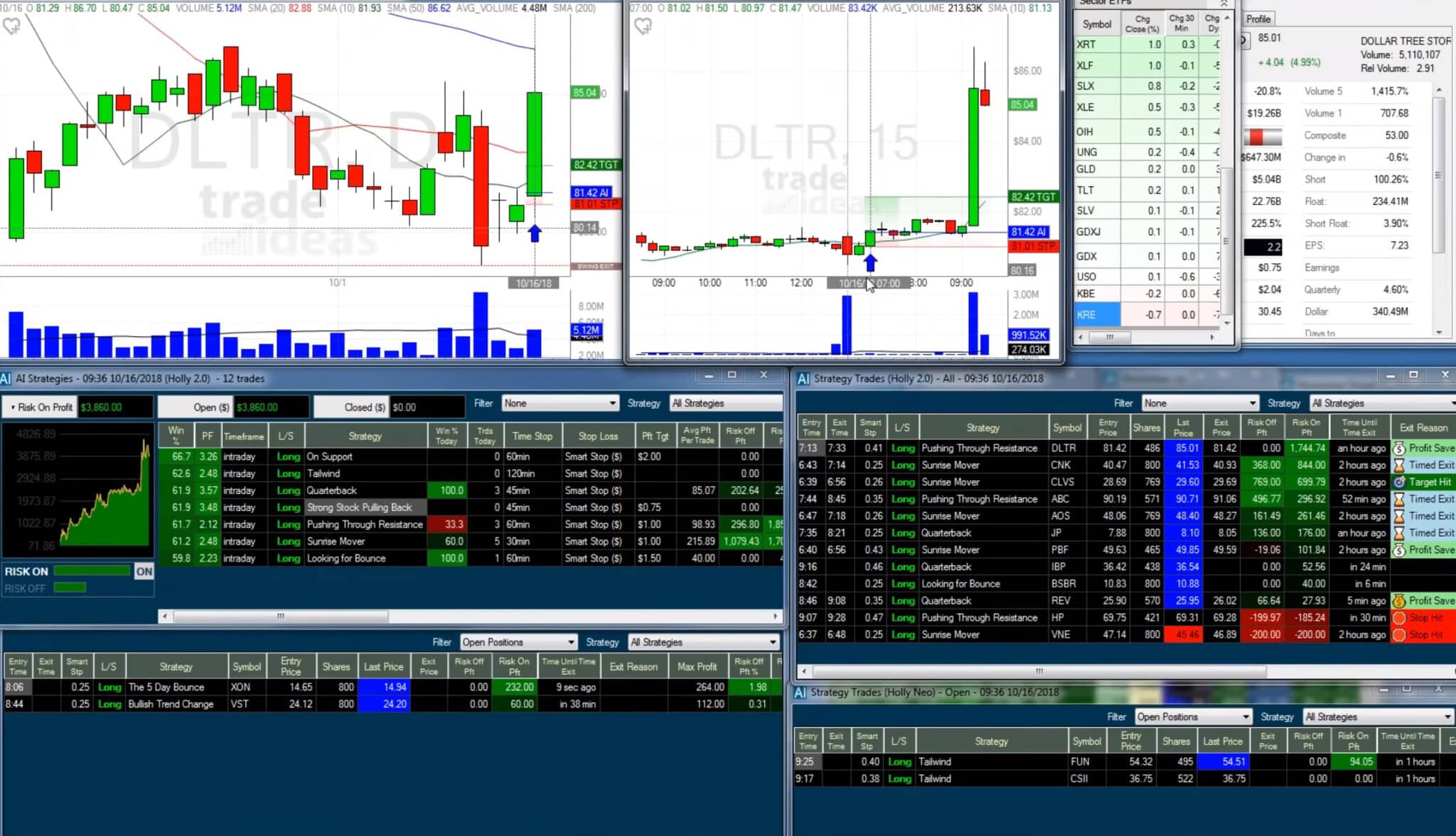

Stock Market Algorithm Software

Zerodha Streak, one of the best algorithm software for trading in India that is only available to Zerodha subscribers. Traders can manage and plan their trades. Advantages of trading software development for professional traders · Access to the global stock market · Stress-free trading · Real-time alerts · Advanced data. SpeedBot an Algorithmic Trading Platform will help you make fortunes in the stock market without direct knowledge of stocks, options, futures, and other markets. Advantages of trading software development for professional traders · Access to the global stock market · Stress-free trading · Real-time alerts · Advanced data. A trading algorithm can also purchase shares and check immediately to see if the transaction has influenced the market price. 3. Minimize human fallacy: As. The algorithms take into account a wide range of market data and information, such as price trends, market volume, and volatility, to make informed trading. A study in showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans. It is widely used by investment. "The new kid on the block, TrendSpider is doing something very different and innovative to separate itself from the crowded stock chart analysis software market. Trade Machine is a comprehensive trading software that offers a range of tools for strategy development, backtesting, and execution. It provides. Zerodha Streak, one of the best algorithm software for trading in India that is only available to Zerodha subscribers. Traders can manage and plan their trades. Advantages of trading software development for professional traders · Access to the global stock market · Stress-free trading · Real-time alerts · Advanced data. SpeedBot an Algorithmic Trading Platform will help you make fortunes in the stock market without direct knowledge of stocks, options, futures, and other markets. Advantages of trading software development for professional traders · Access to the global stock market · Stress-free trading · Real-time alerts · Advanced data. A trading algorithm can also purchase shares and check immediately to see if the transaction has influenced the market price. 3. Minimize human fallacy: As. The algorithms take into account a wide range of market data and information, such as price trends, market volume, and volatility, to make informed trading. A study in showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans. It is widely used by investment. "The new kid on the block, TrendSpider is doing something very different and innovative to separate itself from the crowded stock chart analysis software market. Trade Machine is a comprehensive trading software that offers a range of tools for strategy development, backtesting, and execution. It provides.

Algo trading algorithms collect market data from various sources, such as stock exchanges, news feeds, and economic indicators. This data. MetaTrader 5 is the best free algorithmic trading software for trading forex, stocks, and futures that offers powerful algorithmic trading tools to enable. We at Indira securities believe, algorithm Trading is the future of Trading in stock and commodity markets. Every trader has a life cycle of trading where. Zorro is a free institutional-grade software tool specialized on financial research and algorithmic trading. It's compact, easy to learn, and magnitudes faster. By using algorithms, traders can quickly detect patterns in the market and make decisions based on those patterns in a much shorter time frame than possible. High frequency trading software HFT is a very popular algorithm for trading with fast speeds, high churn, and massive transactions. stock market or other exchanges The algorithm can be backtested on historical market data to see how it would have performed before and provide a more. Algorithms start by collecting vast amounts of historical and real-time market data. This data includes stock prices, trading volumes, economic indicators, and. A trading algorithm is a series of steps to make a buy or sell order in the stock market. According to current market conditions, your order can be executed. Enjoy Tickblaze, a hybrid trading platform for stocks, forex, futures, and crypto. Open to day traders and quants. day free trial! Unlike traditional trading, algo trading relies on algorithms to analyze market data, identify patterns, and execute trades at a speed and. Algo trading is a technique that allows you to make trading decisions based on pre-programmed computer algorithms. It enables faster execution of trades and. software are needed in the securities industry's infrastructure to control In September, NYSE Euronext, the Nasdaq Stock Market, BATS Global Markets. kremlin2000.ru is without a doubt one of the most functional and user-friendly automated trading platforms on the market as of this writing. You can build your. This type of software uses complex mathematical formulas and sophisticated algorithms to analyze market data and identify profitable trades. Algorithmic trading. A time-saving market proven algorithm, delivering buy / short signals based on a combination of 15 unique indicators. A trading algorithm can also purchase shares and check immediately to see if the transaction has influenced the market price. 3. Minimize human fallacy: As. We at Indira securities believe, algorithm Trading is the future of Trading in stock and commodity markets. Every trader has a life cycle of trading where. IBKR offers an algorithmic trading platform called Trader Workstation (TWS). TWS provides access to over global markets with real-time data feeds and. Once the current market conditions match any predetermined criteria, trading algorithms (algos) can execute a buy or sell order on your behalf – saving you time.

Can You Refinance Fafsa Loans

Now you could get student loan refi rates starting at % variable APR with discounts when you open a Laurel Road Linked Checking® account and set up. However, you can't consolidate both federal and private loans through the federal kremlin2000.rute 1. Refinancing. Refinancing occurs when a company buys all. Most federal student loans—including Direct Loans and FFEL Program Loans—are eligible for consolidation. See the full list of loan types by selecting the arrow. Can you refinance federal student loans? Absolutely! But before using private lenders to refinance, you need to determine how important the benefits. If you have both private and federal student loans, you can refinance the private debt and consolidate the federal student loans separately. This still. You can refinance both federal and private student loans. It's possible to get a lower interest rate and new term length to make your loans more affordable. For borrowers who have loans that are owned by the U.S. Department of Education, the only option is to refinance through a private lender, like a big bank. What are the differences between federal and private student loans? · Consolidation and refinancing · Loans can be consolidated into a Direct Consolidation Loan. Student loan refinancing can simplify student loan payments and lower your interest rate. Learn how to refinance federal student loans here. Now you could get student loan refi rates starting at % variable APR with discounts when you open a Laurel Road Linked Checking® account and set up. However, you can't consolidate both federal and private loans through the federal kremlin2000.rute 1. Refinancing. Refinancing occurs when a company buys all. Most federal student loans—including Direct Loans and FFEL Program Loans—are eligible for consolidation. See the full list of loan types by selecting the arrow. Can you refinance federal student loans? Absolutely! But before using private lenders to refinance, you need to determine how important the benefits. If you have both private and federal student loans, you can refinance the private debt and consolidate the federal student loans separately. This still. You can refinance both federal and private student loans. It's possible to get a lower interest rate and new term length to make your loans more affordable. For borrowers who have loans that are owned by the U.S. Department of Education, the only option is to refinance through a private lender, like a big bank. What are the differences between federal and private student loans? · Consolidation and refinancing · Loans can be consolidated into a Direct Consolidation Loan. Student loan refinancing can simplify student loan payments and lower your interest rate. Learn how to refinance federal student loans here.

"Borrowers should not refinance if this will cause their interest rates to increase," says financial aid expert Mark Kantrowitz. "If a borrower has a much. In the US, there are generally 2 types of federal strident loans: FFEL (federal family education loan) and direct loans. Take control of repaying your student loans by refinancing and consolidating your current loans with CommunityAmerica. Refinancing could lower your interest. If you have federal loans, refinancing will reclassify them as private. Refinancing could make you lose federal protection, such as income-based repayment (IBR). Refinancing federal student loans can either help you pay down your loans sooner (by shortening your term) or lower your monthly payment (by extending your term). Can you refinance your federal student loans with the government? Kind of—federal student loan borrowers can consolidate their loans. Consolidation combines. NOTE: Borrowers who refinance federal student loans with a private loan could if you refinance with a private loan. Please compare your current. Refinancing is a good idea if you qualify for a lower rate and you're comfortable giving up the benefits that come with federal student loans. When you. A Consolidation Loan allows you to combine all of your federal student loans into a single loan. Consolidation loans have a fixed interest rate. Loan refinancing is when private lenders consolidate and refinance your federal and private student loans. Through private student loan consolidation, you will. The decision to refinance federal student loans requires thoughtful consideration of all the pros and cons. What you decide to do ultimately depends on what. Consolidation typically refers to combining your federal student loans into one new federal loan with a new term. It does not necessarily provide a lower. When you refinance your federal or private student loan debt with MEFA, you will lose current and future benefits, as well as any protections, associated with. You can refinance both private and federal student loans with a private lender. Refinancing federal student loans with a private loan may cause you to forfeit. Before you refinance your federal student loans with us, take special consideration of the current and potential future benefits of your federal student loans. No. A Direct Consolidation Loan allows you to consolidate multiple federal student loans into one loan at no cost to you. The decision to refinance federal student loans requires thoughtful consideration of all the pros and cons. What you decide to do ultimately depends on what. INvestEd recommends that all potential borrowers with federal student loan debt carefully consider their options before refinancing. You can refinance all federal* and private education loans, including loans from both undergraduate and graduate programs. This includes all Stafford, Federal. College can be challenging – paying for it shouldn't be Whether you want to lower your interest rate, pay your loans off sooner, or reduce your monthly.

How Often Mortgage Rates Change

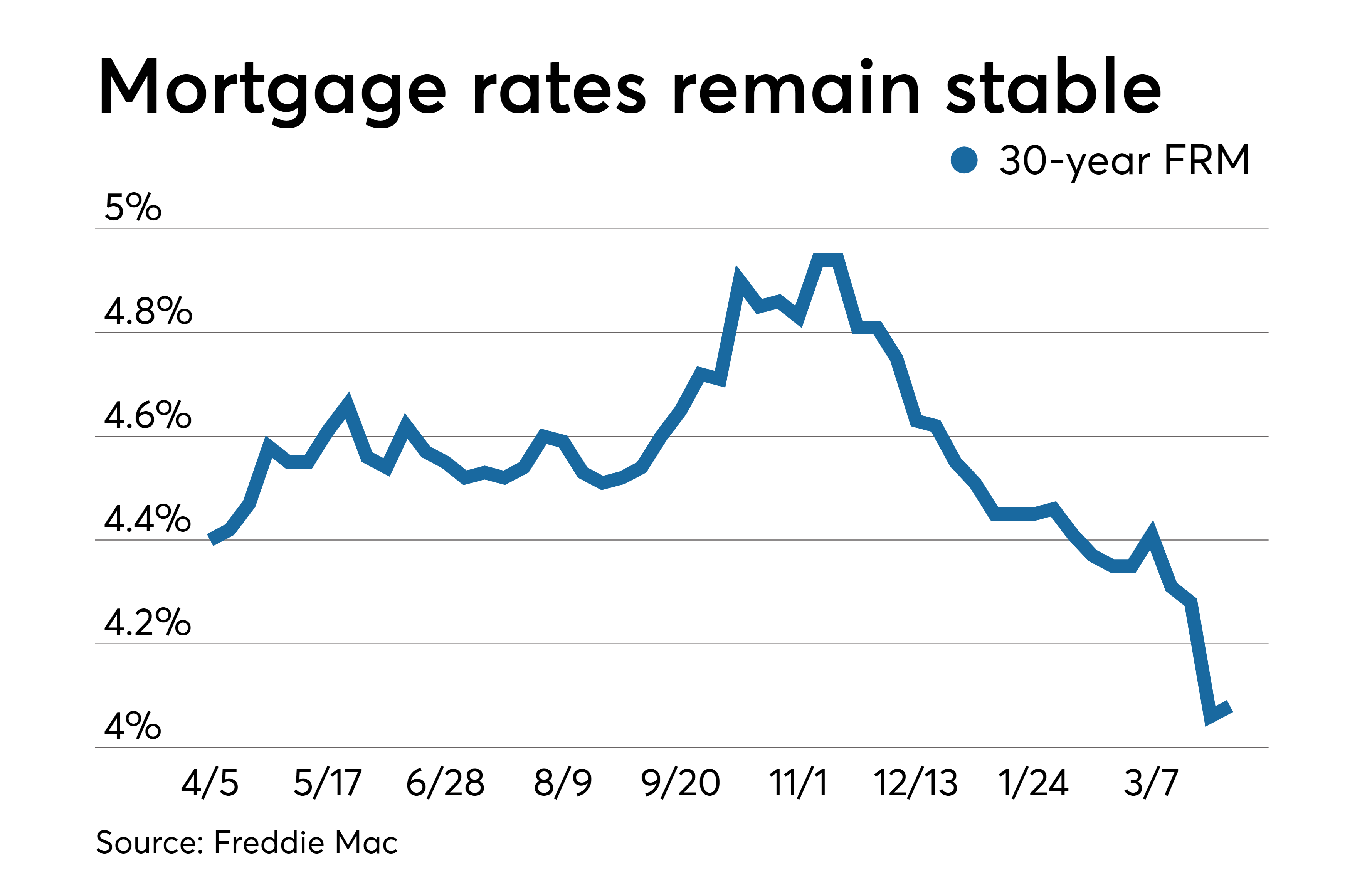

The Loan Estimate shows the initial interest rate you pay at the beginning of your loan term. This row also shows how often your rate can change and how high it. As a result, the interest rate on all our mortgages that track the Bank Rate has been reduced by % from 1 September Our Standard Variable Rate (SVR). As seen in the mortgage rates chart above, mortgage rates go up and down daily. They move up or down according to what's happening in the broad economy: changes. The index is generally updated once per day unless multiple lenders have changed rates during the day. A "top tier" scenario is used as a baseline (75LTV, When you apply and are approved for a year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be. To understand how often variable rates change, you need to understand why they change in the first place as this determines how often rates move up or down. After that, the rate may adjust every six months (the 6m in the 5/6m example) until the loan is paid off. While these are all valid factors, consumers worrying about high interest rates may benefit from putting their rate into larger context. Rates have certainly. Mortgage rates can change daily, sometimes more than once a day. If you're watching rates, it's helpful to know % (a quarter of a percentage point). The Loan Estimate shows the initial interest rate you pay at the beginning of your loan term. This row also shows how often your rate can change and how high it. As a result, the interest rate on all our mortgages that track the Bank Rate has been reduced by % from 1 September Our Standard Variable Rate (SVR). As seen in the mortgage rates chart above, mortgage rates go up and down daily. They move up or down according to what's happening in the broad economy: changes. The index is generally updated once per day unless multiple lenders have changed rates during the day. A "top tier" scenario is used as a baseline (75LTV, When you apply and are approved for a year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be. To understand how often variable rates change, you need to understand why they change in the first place as this determines how often rates move up or down. After that, the rate may adjust every six months (the 6m in the 5/6m example) until the loan is paid off. While these are all valid factors, consumers worrying about high interest rates may benefit from putting their rate into larger context. Rates have certainly. Mortgage rates can change daily, sometimes more than once a day. If you're watching rates, it's helpful to know % (a quarter of a percentage point).

See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Mortgage rates can change due to a number of reasons. One of the reasons is movement in the overall economy. When the economy is strong and inflation is on the. How often can Bank of Canada interest rates change? The Bank of Canada sets the overnight interest rate on eight fixed dates each year. The rate can go up or. when Freddie Mac's Mortgage Rates. Archive. Weekly Data. Date, 30‑Yr FRM, Rate Change, 15‑Yr FRM, Rate Change. September 05, , 30‑Yr FRM %, Rate. How often do mortgage rates change? Mortgage rates can change daily as the economy and housing market fluctuate. However, there is no set schedule of when they. But the increase in year fixed mortgage rates since early has been unusually large relative to rates on long-term Treasury securities, which may suggest. Interest rate risk Most mortgage loans in Canada are renegotiated every 5 years, but they can be as short as 6 months or as long as 10 years. The more often. Interest rates tend to change daily, and sometimes rates even change during the day. You can compare current mortgage rates from our partner lenders here. You. loan or mortgage to choose, or even what APR you should be looking for when opening a new credit card. How often does this rate change? Why? Typically, the. Interest rates change based on your selected loan program. There are fixed-rate mortgages and adjustable-rate mortgages (ARMs), government-backed loans. For example, a "5/1 ARM" has a fixed-rate for five years and then changes every year after that. " 7/1 ARM" loan has a fixed-rate for seven years and changes. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes. The term, or length, of your loan. How often do mortgage rates change? Rates are updated daily based on the index for specific capital sources. Some banks have an internal rate sheet that can. Mortgage rates are constantly changing. While some lenders might update their rates on a daily basis other will tie their rates directly to. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Yes rates change daily. No it's not worth day trading mortgage rates timing the market. If you want a house, apply. You can't time the market. How often can Bank of Canada interest rates change? The Bank of Canada sets the overnight interest rate on eight fixed dates each year. The rate can go up or. However, your monthly mortgage payment may also include interest, taxes, and insurance. While your principal and interest amounts will not change, the amount. How are Mortgage Rates Determined and why do they Change? Importance of Securitization and MBS · Mortgage Interest Rates: Putting It All Together. Mortgage Rate. A major factor driving interest rates is inflation. Higher inflation is associated with a growing economy. When the economy grows too strongly, the Federal.

Mortgage Rates 95 Ltv

Pros of a 95% LTV mortgage · You will require a smaller deposit · It's likely you'll be able to purchase a property sooner · While the interest rates of 95%. A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10% of. LTV stands for loan to value, which is the percentage of the mortgage in relation to the property's value. 95% mortgages are good for first-time buyers, who. A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10%. There are lots of lenders offering 90% loan-to-value: HSBC, Halifax, Nationwide, NatWest, TSB all the high street lenders you would expect. Please bear in mind that your monthly mortgage payments will be higher with a 95% mortgage when compared to a mortgage with a lower LTV. · You always need to. The chart below show the best 95% LTV mortgage rates available to first time buyers. You can personalise the chart by adding the value of the. When you take out a 95% mortgage, you'll put down a deposit of 5% and borrow the remaining 95% of the property's value. These are often called “95% LTV. You can borrow using a 95% LTV up to a maximum of £, on your mortgage amount. 95% mortgages are available to first time buyers, home movers and those. Pros of a 95% LTV mortgage · You will require a smaller deposit · It's likely you'll be able to purchase a property sooner · While the interest rates of 95%. A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10% of. LTV stands for loan to value, which is the percentage of the mortgage in relation to the property's value. 95% mortgages are good for first-time buyers, who. A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10%. There are lots of lenders offering 90% loan-to-value: HSBC, Halifax, Nationwide, NatWest, TSB all the high street lenders you would expect. Please bear in mind that your monthly mortgage payments will be higher with a 95% mortgage when compared to a mortgage with a lower LTV. · You always need to. The chart below show the best 95% LTV mortgage rates available to first time buyers. You can personalise the chart by adding the value of the. When you take out a 95% mortgage, you'll put down a deposit of 5% and borrow the remaining 95% of the property's value. These are often called “95% LTV. You can borrow using a 95% LTV up to a maximum of £, on your mortgage amount. 95% mortgages are available to first time buyers, home movers and those.

Looking for mortgages that require a 5% deposit or 5% equity in your home? Find the Best 95% LTV Mortgage Rates for you and apply today. A 95% LTV mortgage allows you to borrow up to 95% of your property value or the purchase price, whichever is lower - this means that you only need to contribute. Mortgage at 95% Loan to Value will cover 95% of the property purchase price, with Loan to Value often abbreviated to LTV, so a 95 mortgage means a 5%. LTV ratio rules for common mortgage programs ; Conventional, Purchase (fixed rate), 97% ; Conventional · Purchase (adjustable rate), 95% ; Conventional · Rate-and-. 95% mortgages enable you to borrow up to 95% of the purchase price of the property you want to buy, with the remaining 5% made up of your deposit. A mortgage that has a loan-to-value rate of 95% requires just a 5% deposit. If the borrower meets their chosen lender's mortgage criteria, they can borrow up to. Mortgage lending, the amount of deposit you can put down on a property can affect the interest rates and terms offered by banks and lenders. A smaller deposit. The 95% LTV is helpful to buyers with small deposits, which can help you own a home. However, a small deposit comes with higher interest rates and monthly. A 95% mortgage allows potential homeowners to borrow 95% of the amount of capital needed to purchase a house, while only needing a deposit of 5% of the. Product & Rates. Can I get a 95% LTV (loan to value) mortgage? Can I get a 95% LTV (loan to value) mortgage? Find out our criteria for 95% LTV mortgages. A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10%. 95% mortgages are also referred to as 95% LTV mortgages (LTV stands for Loan to Value) or 5% deposit mortgages. Our 95% mortgage deals. Our 95% mortgages are. Latest average two-year fixed-rate mortgage rates ; 60% LTV, %, % ; 75% LTV, %, % ; 85% LTV, %, % ; 90% LTV, %, % ; 95% LTV, %. 95% is the highest LTV widely available, although a few lenders can offer % mortgages. They often have certain restrictions and higher interest. Latest average two-year fixed-rate mortgage rates ; 60% LTV, %, % ; 75% LTV, %, % ; 85% LTV, %, % ; 90% LTV, %, % ; 95% LTV, %. A 95% mortgage is also known as a 95% loan to value (LTV) mortgage. It means you can borrow 95% of the value of a property. So your deposit only needs to be 5%. Looking for a mortgage lender with 95% loan-to-value? AAA Lendings offers competitive rates and easy approval process. Find your dream home today! A 95% mortgage allows buyers, whether first time buyers or movers, to secure a home with only a 5% deposit, with the remaining 95% covered by the mortgage. A 95% mortgage allows first time buyers and home movers to borrow up to 95% of the property value, as part of the government's mortgage guarantee scheme. Are mortgage rates now lower than your current Star One mortgage rate? loans to $1,, (95% LTV). 10% down payment: loans to $2,, (

1 2 3 4 5