kremlin2000.ru

Learn

Taxable Brackets 2021

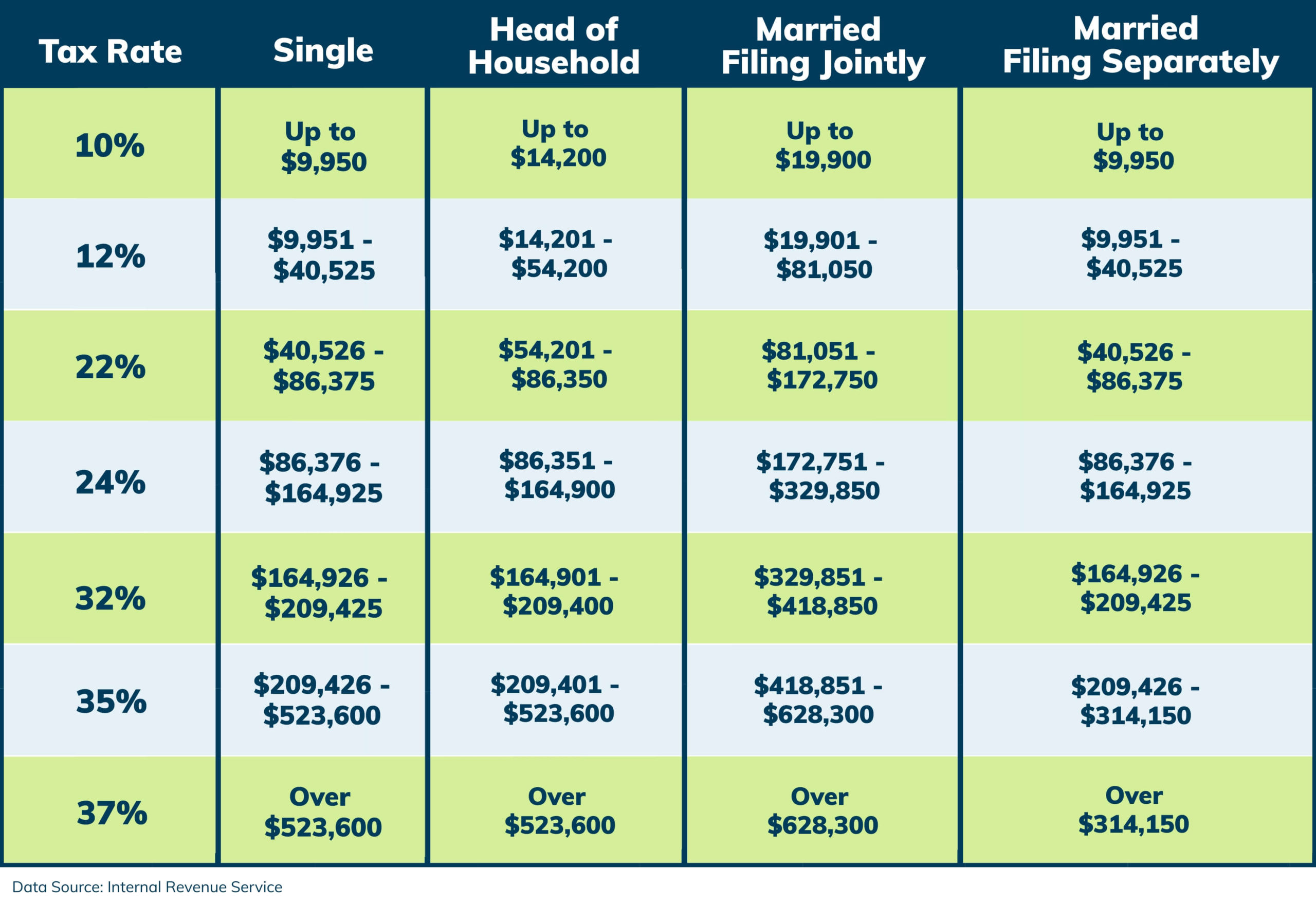

Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Use this calculator to compute your Virginia tax amount based on your taxable income. Copyright © Virginia Department of Taxation. All rights. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, In , the top marginal tax rate was reduced from % to % beginning with Tax Year However, the top marginal ordinary tax rate was further reduced. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return. Tax brackets (Taxes due in ) ; Tax Rate, Single Filers/ Married Filing Separate (MFS), Married Individuals Filing Jointly/ Qualifying Surviving Spouses. The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly ; 10%, up to $9,, up to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to. Source: IRS Revenue Procedure Table 4. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Use this calculator to compute your Virginia tax amount based on your taxable income. Copyright © Virginia Department of Taxation. All rights. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, In , the top marginal tax rate was reduced from % to % beginning with Tax Year However, the top marginal ordinary tax rate was further reduced. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return. Tax brackets (Taxes due in ) ; Tax Rate, Single Filers/ Married Filing Separate (MFS), Married Individuals Filing Jointly/ Qualifying Surviving Spouses. The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly ; 10%, up to $9,, up to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to. Source: IRS Revenue Procedure Table 4. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout.

Tax Rates ; January 1, – December 31, , % or ; January 1, – December 31, , % or ; January 1, – December 31, , %. For Tax Years , , and the North Carolina individual income tax rate is % (). For Taxable Years beginning in , the North. 2 percent on first $ of taxable income; 4 percent on next $2,; 5 percent on all over $3, Married persons filing a joint return with adjusted gross. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. For tax year , the 28% tax rate applies to taxpayers with taxable incomes above USD , (USD , for married individuals filing separately). Corporate Income Tax Rates - On or after January 1, and before January 1, ; $0- $25,, % ; $25, $,, % ; $, $,, % ; >. Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. NOTE: · for taxpayers who have a net taxable income between $1 and not exceeding $25,; · for taxpayers who have a net taxable income between. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. Step 2: Apply the Tax Rates to Each Bracket · The first $11, of your taxable income is taxed at 10%. · The next portion of $33, (from $11, to $44,) is. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Single filers for tax year who have less than $9, in taxable income are subject to the 10% income tax rate, which is the lowest bracket. Every dollar. As Will Rogers said: “The difference between death and taxes is death doesn't get worse every time Congress meets.” In , the top tax bracket was 7 percent. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Income Tax Brackets Are Based on Your Income and Filing Status. Use the kremlin2000.ru Income Tax Calculator to Determine Your Tax Brackets. Tax Information for Individual Income Tax For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Tax Brackets & Rates ; , ; 10%, 0 – $9,, 10% ; 12%, $9, – $40,, 12% ; 22%, $40, – $85,, 22%. Marginal tax rates and income brackets for Marginal tax rate, Single taxable income, Married filing jointly or qualified widow(er) taxable income. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Rates for Tax Years ; Over $60, but not over $, $3,, plus % of the excess over $60, ; Over $, but not over $1,,

Usws Stock Buy Or Sell

:max_bytes(150000):strip_icc()/BuySellandHoldRatingsofStockAnalysts3-6fc3f5431b974f20bb9585fc61fec4a7.png)

Find the latest Snowflake Inc. (SNOW) stock quote, history, news and other vital information to help you with your stock trading and investing. The basic categories most often used include stock market sectors: The markets where people buy and sell stock come in several different flavors. USWS Stock Predictions - Should I buy USWS stock? USWS buy or sell? Get a free USWS technical analysis to help you make a better USWS stock forecast. price history, would already be reflected in the current price of the stock. used to form stop prices for buying or selling. Outputs from the individual. As a currency trader, what do you buy and sell? Currencies, of course! That may seem like a silly question to ask a group of Forex traders. But here's the thing. If you want to sell stock content, you need to create your own designs from scratch. Jenny uses stock photos of food from the Canva library throughout her e-. There are two ways to buy Air Liquide shares: either directly from Air Liquide, or from a financial institution, for example a bank. Stock rises to $70 and you sell shares: $14, Repay margin loan: $5, Imagine again that you used $5, cash to buy shares of a $50 stock. We reveal the 8 most accurate stock predictors for We rank the leading stock prediction services by pricing, past returns, target markets, reputation. Find the latest Snowflake Inc. (SNOW) stock quote, history, news and other vital information to help you with your stock trading and investing. The basic categories most often used include stock market sectors: The markets where people buy and sell stock come in several different flavors. USWS Stock Predictions - Should I buy USWS stock? USWS buy or sell? Get a free USWS technical analysis to help you make a better USWS stock forecast. price history, would already be reflected in the current price of the stock. used to form stop prices for buying or selling. Outputs from the individual. As a currency trader, what do you buy and sell? Currencies, of course! That may seem like a silly question to ask a group of Forex traders. But here's the thing. If you want to sell stock content, you need to create your own designs from scratch. Jenny uses stock photos of food from the Canva library throughout her e-. There are two ways to buy Air Liquide shares: either directly from Air Liquide, or from a financial institution, for example a bank. Stock rises to $70 and you sell shares: $14, Repay margin loan: $5, Imagine again that you used $5, cash to buy shares of a $50 stock. We reveal the 8 most accurate stock predictors for We rank the leading stock prediction services by pricing, past returns, target markets, reputation.

The position could be exited completely, but buying back the calls will cost more money than the position was initially opened for, so the outlook for the stock. The stock market is where investors can buy and sell shares of publicly traded companies. Used under licence. iSHARES is a registered trademark of. These are things you buy or sell but don't (or can't) track as stock. For example, nuts and bolts used in an installation. Create bundles: Bundles let you group. Select from buy, sell, dividend, fee, or split. Stock: Enter the stock ticker; Transacted Units: Enter the number of shares purchased, sold, receiving dividends. The money only goes to the company when they first sell the stock to the public. After that, any time the stock is sold, the money goes to the person who sold. Experience Online Car Buying. When you find the vehicle you want, you have the convenient option to purchase it through our website. We offer a user-friendly. This group is for buying, selling, or trading of low profile livestock trailers. Used Low Pro Stock Show Tr 12K members. Join. New listing activity. If the reinvested dividends buy shares at a price equal to their fair sell the stock. If your employer or former employer doesn't provide you with. Here is a list of 10 commonly used stock analysis tools: 1 stock reaches a price at which you want to buy or sell kremlin2000.rud: Growth vs. The Total Equity is the number that is used to determine rankings. Available Equity is the amount of equity available for additional buy and short sell. Moving averages are one of the simplest and most commonly used technical indicators. Short-term buy and sell signals can be generated by crossovers of 2 moving. Stock screeners are used to identify stocks based on different investing buying or selling financial instruments. more · Agency Broker: What It Means. In other words, if you buy a security several times at different prices (ie: cost averaging) and you decide to sell in lots over time, this app will let you. buying or selling one or more companies' shares. Traders obtain profit used by Transformer factors (also used stock turnover rates and price data). sell or avoid buying stocks when there are indications of major institutional selling. used to identify the overall direction of a stock's price, up or. Learn how to buy McDonald's stock This website uses cookies to better understand how visitors use our site, for advertising, and to offer you a more. Explore our wide range of wholesale cell phones in bulk. Discover accurately graded, used Apple iPhones, iPads, watches, and Samsung devices, ready for. Lifted Trucks offers the best lifted trucks, custom trucks, diesel, 4x4 trucks and more at our dealerships in Arizona, Texas & Alabama. Shop used trucks. They only have template with buy recommendation but not for Sell and Hold recommendation. used stock pitch coaching service? Thanks. Reply. M&I - Brian. Since then, beta is being used as a method of calculating the risk within an investor's portfolio. It helps investors in analyzing which stocks to buy/sell from.

Monthly Income Of Uber Driver

The money you make driving with the Uber app depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. But the fact is that the average salary for Uber drivers in the U.S. is about $63, a year as of October 22, , which is 15% above the national average. On average, an Uber driver in New York City can make $ a year or $52 an hour. Learn more about Uber salaries and how to get started. The average uber driver salary in Illinois is $35, per year or $ per hour. Entry level positions start at $35, per year while most experienced. The money you make with Uber depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. If you earn more than $ from Uber or Lyft, you must file a tax return and report your driving earnings to the IRS. Most Uber and Lyft drivers report income. While kremlin2000.ru is seeing that Uber Driver salary in the US can go up to $65, or down to $31,, but most earn between $38, and $55, kremlin2000.ru While kremlin2000.ru is seeing that Uber Driver salary in California can go up to $61, or down to $29,, but most earn between $36, and $52, kremlin2000.ru A uber driver can make anywhere between $ to $ a week depending on your work enthics and u are willing to drive anywhere between 7 to The money you make driving with the Uber app depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. But the fact is that the average salary for Uber drivers in the U.S. is about $63, a year as of October 22, , which is 15% above the national average. On average, an Uber driver in New York City can make $ a year or $52 an hour. Learn more about Uber salaries and how to get started. The average uber driver salary in Illinois is $35, per year or $ per hour. Entry level positions start at $35, per year while most experienced. The money you make with Uber depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. If you earn more than $ from Uber or Lyft, you must file a tax return and report your driving earnings to the IRS. Most Uber and Lyft drivers report income. While kremlin2000.ru is seeing that Uber Driver salary in the US can go up to $65, or down to $31,, but most earn between $38, and $55, kremlin2000.ru While kremlin2000.ru is seeing that Uber Driver salary in California can go up to $61, or down to $29,, but most earn between $36, and $52, kremlin2000.ru A uber driver can make anywhere between $ to $ a week depending on your work enthics and u are willing to drive anywhere between 7 to

Average Uber Driver hourly pay in the United States is approximately $, which is 16% above the national average. Salary information comes from 1, data. The earnings that you transfer to a debit card through Instant Pay will appear on every weekly statement as Instant Payouts. Any remaining earnings, including. Want to know how you get paid? Uber provides two straightforward methods for drivers to receive their earnings: Direct deposit. Automated weekly payments. Uber Eats Driver FAQ · Can you make good money with Uber Eats? Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. · Can you. How much do Uber Taxi Driver jobs pay in Manhattan, NY per hour? The average hourly salary for a Uber Taxi Driver job in Manhattan, NY is $ an hour. Average salary for request uber driver: $ for year. Data taken from As of August 28, , the average monthly income for the represented position in. Uber's average pay to drivers seems to hover around $$ Average Uber drivers working 20 hours per week would make around $ Does Uber pay for gas? Uber. Average Uber driver income is $ per hour after expenses and fees. High-paying cities include San Francisco, Seattle, and Long Island (~$25/hour). Factors. Average Earnings of Uber Drivers in Arizona: As of October 25, , the average salary for Uber drivers in Arizona is approximately $37, However, this. I'm in Houston which is bottom of the pay barrel. Some days I might squeeze or $15/hr. Others $30ish. I'm part time so depends on my goal for. Average Uber Drivers Delivery Driver monthly pay in the United States is approximately $2,, which is 20% below the national average. Salary information. The average uber driver salary in the USA is $36, per year or $ per hour. Entry level positions start at $34, per year while most experienced workers. Average Uber Driver salary in India is ₹ Lakhs per year for employees with less than 1 year of experience to 15 years. Driver salary at Uber ranges. Uber Drivers Able To Make Over $ Monthly Driving Uber. Average monthly pay for Uber Drivers: $ This salary trends is based on salaries posted anonymously by Uber employees. The money you make driving with the Uber app depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. It's relatively easy to make $15 - $20 an hour driving for Uber. But how about making over $ an hour or six figures driving for Uber? Earnings vary weekly and monthly. They depend on the number of trips you take, where and when you drive, and other factors. Your overall net income from driving for Uber is up to you. Some Uber drivers have made up to $90, or more a year after working for many hours. Your annual.

Residential Solar Pricing

Solar panel costs typically range from $17, to $23,, but many homeowners will pay around $20, on average. Solar panels are a considerable. Installing a residential solar photovoltaic (PV) panel array has the potential to greatly reduce your home's dependence on grid-based electricity. The average cost ($ per watt) of the average solar system (5 kW) in the United States is approximately $10, after available tax credits. By installing a solar panel system on your home, you can save money on your electricity bill, get credit for the extra electricity you produce, and. O&M Cost – Ongoing cost per year either provided by the solar installation contractor or estimated to be around $0-$/yr for home solar systems. This will. Cost of Installing Ground-Mounted Solar Systems for Homes. The average homeowner can expect to pay between $27, and $60,+ for a ground-mounted solar. Since , the average price of residential solar panels has dropped from $ per watt to $ per watt. Ready to go solar? Call to be. PV, Photovoltaic, Panel Installation costs. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated. Solar panel costs typically range from $17, to $23,, but many homeowners will pay around $20, on average. Solar panels are a considerable. Installing a residential solar photovoltaic (PV) panel array has the potential to greatly reduce your home's dependence on grid-based electricity. The average cost ($ per watt) of the average solar system (5 kW) in the United States is approximately $10, after available tax credits. By installing a solar panel system on your home, you can save money on your electricity bill, get credit for the extra electricity you produce, and. O&M Cost – Ongoing cost per year either provided by the solar installation contractor or estimated to be around $0-$/yr for home solar systems. This will. Cost of Installing Ground-Mounted Solar Systems for Homes. The average homeowner can expect to pay between $27, and $60,+ for a ground-mounted solar. Since , the average price of residential solar panels has dropped from $ per watt to $ per watt. Ready to go solar? Call to be. PV, Photovoltaic, Panel Installation costs. Buying a solar energy system will likely increase your home's value. A recent study found that solar panels are viewed as upgrades, just like a renovated.

An average-sized residential system has dropped from a pre-incentive price of $40, in to roughly $25, today, while recent utility-scale prices range. NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial rooftop, and utility-scale ground-mount. The current average price range in Ontario is about $$ per watt. (not sure what this number means or how to use it? Jump back up to the Common. We offer a customized solar-plus-battery solution that enables you to access and store the free, abundant power of the sun reducing your reliance on fossil. The upfront price for an average-sized residential solar system has fallen from $40, in to about $25, today. Meanwhile, utility-scale solar now costs. Although there are some restrictions and limitations as to who can choose solar power versus residential electricity, most homeowners in Ontario can now. The first thing I found was this: “According to our solar experts, solar panels cost about $ to install in the United States. Residential solar panels cost $ per watt, according to data from the energy consulting firm Wood Mackenzie. That's 7 cents lower than the firm's estimate. Soft costs include the cost of installation labor, the cost of all relevant permits, and all overhead costs including the marketing, sales and administrative. When you install a solar photovoltaic (PV) system, you reduce the use of fossil fuels, curb greenhouse gas emissions and promote energy independence. REC N-PEAK RECNP3 W Solar System Prices ; KW, 24, SolarEdge SEH-US / Enphase IQ8A, ft · $12, $/watt ; KW, 26, SolarEdge SEH-. Compare solar price plans ; Summer ratesMay/June/Sept./Oct. prices per kWh · Super off-peak¢ ; Summer peak ratesJuly through August prices per kWh, On-peak NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial rooftop, and utility-scale ground-mount. Solar Panel Installation Cost · Current industry average cost = between $3 to $4 per watt · Average size solar panel system = around 7 kilowatts (a kilowatt is. Looking at national average pricing data, we found that the cost We recommend you use a SunPower-approved installer for your residential solar power system. An average-sized residential system has dropped from a pre-incentive price of $40, in to roughly $25, today, while recent utility-scale prices range. Solar panels generate energy for you to use in your home. When paired with Powerwall, you can store your excess energy for use whenever you want. As severe. From permitting (in some areas) to project installation, engineering, materials such as the panels themselves, and labor, adding home solar panels will. The average cost for solar panels in Kansas is $ per watt. Most residents have monthly energy demands that require a 9 kilowatt (kW) system. Solar Panel Installation Stat According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on.

The Best Laptop For Stock Trading

Acer Aspire 3 AP-R7VH Slim Laptop | " Full HD IPS. Trading laptops would be built for performance and corporate use. Keeping these factors in mind, we suggest the MacBook Pro as the best choice. However, the. The Best Laptops for Trading · Benefits of Trading Laptops · The Best Laptops for Trading in · 1- HP 14 Laptop · 2- Acer Nitro 5 AN–55–53E5. Macs are generally easy to set up, start up, use, and even maintain. A Mac can go from cold boot to live trading in well under a minute. Shop Laptops at kremlin2000.ru and find popular brands including Dell, HP, Samsung, Apple and Acer. Save money. Live better. For security purpose Apple still remains the best. Though I believe the exchange one trades on is far more important than the laptop. Most agree that Lenovo's ThinkPads are the highest quality enterprise laptops because of their high quality trackpads and keyboards, and they're tested to. The ASUS ZenBook Pro Duo 15 OLED is my pick for the best overall trading laptop in It comes with an Intel Core i9 processor, 32GB of RAM, a 1TB, GeForce. Get Your EZ Trading Computer for FREE! · Supercharged Laptops for Traders On The Move! · NEW! · World's Fastest Laptop for Trading: · The Odyssey X7 EZ Laptop. Acer Aspire 3 AP-R7VH Slim Laptop | " Full HD IPS. Trading laptops would be built for performance and corporate use. Keeping these factors in mind, we suggest the MacBook Pro as the best choice. However, the. The Best Laptops for Trading · Benefits of Trading Laptops · The Best Laptops for Trading in · 1- HP 14 Laptop · 2- Acer Nitro 5 AN–55–53E5. Macs are generally easy to set up, start up, use, and even maintain. A Mac can go from cold boot to live trading in well under a minute. Shop Laptops at kremlin2000.ru and find popular brands including Dell, HP, Samsung, Apple and Acer. Save money. Live better. For security purpose Apple still remains the best. Though I believe the exchange one trades on is far more important than the laptop. Most agree that Lenovo's ThinkPads are the highest quality enterprise laptops because of their high quality trackpads and keyboards, and they're tested to. The ASUS ZenBook Pro Duo 15 OLED is my pick for the best overall trading laptop in It comes with an Intel Core i9 processor, 32GB of RAM, a 1TB, GeForce. Get Your EZ Trading Computer for FREE! · Supercharged Laptops for Traders On The Move! · NEW! · World's Fastest Laptop for Trading: · The Odyssey X7 EZ Laptop.

What is the best trading Laptop? And if you are looking for a great travel monitor, check out the ASUS MBB+. It's a ” monitor that weighs less than 2. 1. Dell XPS 13 Plus · 2. HP Spectre x 14 · 3. Lenovo ThinkPad X1 Carbon Gen 10 · 4. Microsoft Surface Laptop Studio · 5. Asus ZenBook Pro Duo Lenovo IdeaPad 3 has great potential for becoming a good stock trading laptop. It features the latest AMD Ryzen 3 U mobile processors with Radeon Vega 3. To make your search for the best day trading computer graphics card easy, you should have it at the back of your mind that two major companies manufacture the. Best Laptop For Stock Trading · Dell Inspiron Touch Screen Laptop · Lenovo Legion Y Gaming Laptop · ASUS Zen Book 15 · Acer Aspire E15 · Apple MacBook. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access. Yes, the article suggests that day trading with a laptop may enhance profitability, especially for mechanical traders who rely on automated systems. Mechanical. When you're looking for the best laptop for trading, choose a model with a solid-state drive (SSD). SSDs are much faster than traditional hard disk drives (HDDs). Acer Aspire Lite AMD Ryzen 5 U Premium Thin and Light Laptop (16 GB RAM/ GB SSD/Windows 11 Home) AL, cm (") Full HD Display, Metal Body. The MacBook Pro, Dell XPS 13, Lenovo ThinkPad X1 Carbon, and HP Spectre x are all excellent choices for traders in Choose the one that best suits your. What Kind Of Computer Is Best For Stock Trading? · Processor – Intel i5 8 core or better · RAM – 16 GB · Graphics Card – Nvidia or better · Hard Drive – SSD. Here are ten laptops that stand out for their performance and features when it comes to navigating the fast-paced world of stock trading. First. Apple MacBook Pro M3 Pro Chip-best laptop for day trading · Acer Aspire Vero AV Green PC-best laptop for stock trading · Lenovo ThinkPad P1 Gen 6-best. The only difference in a trading computer and one that you could just run down to your local Best Buy and pick up is the computer's ability to support multiple. Trading does not require an expensive PC or Laptop with lots of processing power. For most users, a computer with 16GB of ram, an 8-core Intel i5 or Ryzen. The best laptop for trading stocks and options is the Dell Inspiron Touchscreen. It comes with an 8th Gen Intel Quad-Core iU. If you are looking for a reliable but affordable option in the best pc for stock trading, check out the ThinkStation P Tower Workstation. The Best Laptop for: Stock and Crypto Traders. Many traders are self-employed and have a natural path to a digital nomad lifestyle. With only the market to. Best Gaming Laptop for Stock Trading (Razor Blade 15). The Razer Blade 15 has long dominated the high-end market, frequently ranking among the best gaming. Here we will discuss the Best Laptop which will come in your budget with the best features- A)-If your Budget Range is 25kk then these are the following.

Dispute Bad Credit Report

Lingering negative information that ought to have aged out; everything but personal bankruptcy (10 years) should drop off your report after seven years. This may temporarily mask legitimate negative information, but accurate information cannot legally be removed from a credit report except by paying off a debt. Clearly identify each mistake separately, state the facts, explain why you are disputing the information, and request that it be removed or corrected. Some of. Why can't I dispute my credit score? Your score is calculated based on the information in your credit report. It factors in payment history, length of credit. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they. If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished. You may also submit your letter of dispute and supporting documentation online by going to the websites of the three major credit reporting agencies (Equifax. Summary of What to Do When a Credit Bureau Doesn't Respond · contact the creditor directly · file another dispute with the credit reporting agency but include. You can dispute the information with the creditor in writing. Many creditors, like credit card companies or banks, have an address where you can send your. Lingering negative information that ought to have aged out; everything but personal bankruptcy (10 years) should drop off your report after seven years. This may temporarily mask legitimate negative information, but accurate information cannot legally be removed from a credit report except by paying off a debt. Clearly identify each mistake separately, state the facts, explain why you are disputing the information, and request that it be removed or corrected. Some of. Why can't I dispute my credit score? Your score is calculated based on the information in your credit report. It factors in payment history, length of credit. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they. If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished. You may also submit your letter of dispute and supporting documentation online by going to the websites of the three major credit reporting agencies (Equifax. Summary of What to Do When a Credit Bureau Doesn't Respond · contact the creditor directly · file another dispute with the credit reporting agency but include. You can dispute the information with the creditor in writing. Many creditors, like credit card companies or banks, have an address where you can send your.

To dispute an error on a credit report, you'll need to contact each credit bureau that published the error. Mistakes can appear on one report only or all three. If you dispute your credit reports online, you make it difficult to enforce the law, and it slows you down. Eventually, if you are correct, it will require. You have a right to dispute any information in your credit report you believe is wrong. How Long Does Negative Information Stay on My Credit Report? Dispute wording can be put on a credit report account by the creditor, by one of the credit bureaus: Experian, Equifax, or TransUnion, or by both. Understanding. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. What documents will I need to provide for my dispute? · Personal Information. Valid driver's license; Birth certificate · Account Information. Current bank. If the credit bureau refuses to correct your report after conducting an investigation, you may write to the credit bureau and ask it to include a statement of. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. If any piece of information on your credit report is inaccurate, incomplete, or unrecognizable, it's critical to contact the source of the information, as well. in most cases, they ask the debt holder for verification and have a certain number of days to respond. many bad credit marks are removed on. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be. You can still file a written statement of dispute with the credit bureaus that can be included in your credit report. You can ask the credit bureau to provide. In most cases, the credit reporting agency will refer the dispute to the creditor, debt collector or other information provider that first supplied the. Under the FCRA, you can dispute all incomplete and inaccurate information in your credit report with the agency that made the report. So if there are credit reporting errors showing up on those reports, it's important that you dispute the errors with the responsible credit bureaus and. If that's the case, ask the credit bureau to include your statement of the dispute in your file and in future reports. If requested, the credit bureau will also. If you have reviewed your credit report and believe it contains errors, you have the right to dispute inaccuracies with the credit reporting agencies. To request a correction to the information on your credit report, contact the relevant credit provider in the first instance to enquire about the information in. There are a few different ways to dispute errors on your credit report. You can dispute errors by writing to the credit bureau, or by calling. If any piece of information on your credit report is inaccurate, incomplete, or unrecognizable, it's critical to contact the source of the information, as well.

How Much Does Bed Bug Heat Treatment Cost

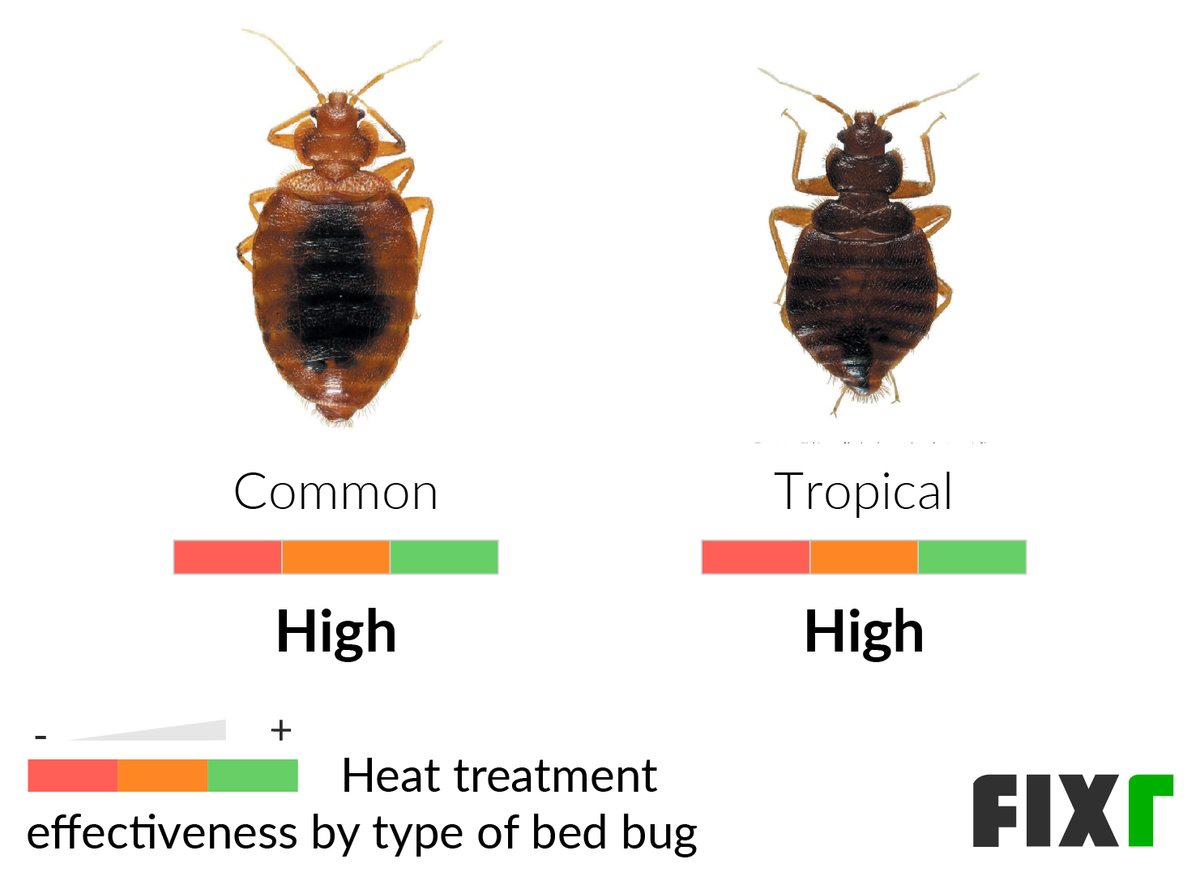

The average cost here can range from $12 to $16 per unit for a building-wide treatment. This method is often chosen due to its effectiveness in exterminating. bed bug exterminator cost chemicals- how much does bed bug extermination cost? · $ per bedroom (Palm City, FL) · $2, whole house (Virginia) · $1, (Atlanta). According to HomeAdvisor, bed bug removal can cost anywhere from $ to $5,, with the typical bed bug exterminator cost falling between $1, and $3, Additionally, bed bugs can infest various modes of transportation. Unlike many other pests, proper hygiene does not prevent bed bug infestations. Mice. The lifespan of bed bugs can vary, but the average is around 10 months. Exterminators state when you travel, you're at risk of encountering bed bugs in. This temperature is maintained for about 4 hours to guarantee thorough elimination of bed bugs. Preparing for Bed Bug Heat Treatment. Q. Are there specific. Benefits of Heat Treating Bed Bugs in Vancouver, Canada · Our bed bug heat treatment is also cost effective, and welcomed by most apartment complexes as well. ***The AVERAGE cost to have a home treated for bed bugs is about $ (one dollar) per square foot. So, if you have a home that is square feet, you are. Any substantial company offering heat treatment will likely cost $3,$6, on a home that's under 2, square feet. Any company offering lower rates will. The average cost here can range from $12 to $16 per unit for a building-wide treatment. This method is often chosen due to its effectiveness in exterminating. bed bug exterminator cost chemicals- how much does bed bug extermination cost? · $ per bedroom (Palm City, FL) · $2, whole house (Virginia) · $1, (Atlanta). According to HomeAdvisor, bed bug removal can cost anywhere from $ to $5,, with the typical bed bug exterminator cost falling between $1, and $3, Additionally, bed bugs can infest various modes of transportation. Unlike many other pests, proper hygiene does not prevent bed bug infestations. Mice. The lifespan of bed bugs can vary, but the average is around 10 months. Exterminators state when you travel, you're at risk of encountering bed bugs in. This temperature is maintained for about 4 hours to guarantee thorough elimination of bed bugs. Preparing for Bed Bug Heat Treatment. Q. Are there specific. Benefits of Heat Treating Bed Bugs in Vancouver, Canada · Our bed bug heat treatment is also cost effective, and welcomed by most apartment complexes as well. ***The AVERAGE cost to have a home treated for bed bugs is about $ (one dollar) per square foot. So, if you have a home that is square feet, you are. Any substantial company offering heat treatment will likely cost $3,$6, on a home that's under 2, square feet. Any company offering lower rates will.

Of course, the cost of a bed bug heat treatment depends on the number of rooms affected and other factors. To find out how much it would cost to treat a bed bug. Bedbug Heat Treatment Cost Heat treatment is a low-cost, reasonably effective method of eliminating bedbugs at around $1 to $3 per square foot or $ to $ Bed Bug Heat Treatment Equipment Rentals Our Bed Bug Heater packages are designed to use common power sources without the use of a generator. Did you know that bed bugs are resistant to many chemicals? It's true. Pesticides are losing their potency, forcing many to search for new ways to treat bed. When a bed bug infested house is exposed to about 48°c of heat for about 20 minutes, all adult bed bugs in the house will die. Our bed bug heat remediation treatment follows simple but proven scientific principles to eliminate bed bugs. We employ aeration times far exceeding what is. Lowest price bed bug killers in Toronto. Toronto bed bugs are on the rise. Money-back bed bug extermination in Toronto. Find out how to get rid of bed bugs. Bug heat treatments are labor-intensive and require expensive equipment. An average-size Phoenix, Arizona home will cost +$ Preparation is critical to. Bedbug Heat Treatment Cost Heat treatment is a low-cost, reasonably effective method of eliminating bedbugs at around $1 to $3 per square foot or $ to $ It is a little bit like wearing a belt and suspenders, but it has proven effective for our clients. How much does a bed bug heat treatment cost? There's a. How to prepare for the bed bug treatment process? How do I prevent bed bugs from entering my home? What to do if you. When it comes to hiring professionals to tackle this issue, many homeowners wonder about the bed bug removal cost involved. The price of bed bug extermination. Single Room Heat Treatment: This method involves heating a room to a temperature lethal to bed bugs. For a single room, the cost can range from $ to $1, Cost of bed bug treatment · $ for single room. · No guarantee with chemical treatment. · $ per room when treating 2 or more rooms at the same time. treatments are both a cost and time effective method for eliminating bed bug infestations. Often times our bed bug heat treatment technicians will move and. BED BUG HEAT SUPER SALE PACKAGE | CONVECTEX BED BUG HEATERS · VERSAPRO BED BUG HEAT PACKAGE | CONVECTEX BED BUG HEATERS · 70K Max Bed Bug Treatment Heater · Bed. Bed Bug Heat Exterminator is a professional, full-service in-home heat treatment for bed bugs. Price- If something sounds like it's too good to be true, it probably is. It's understandable that you want to find something that works with your budget, but. How much does a bed bug exterminator cost? Learn more about bed bug treatment costs & services with Orkin. Call an Orkin Pro for bed bug control today. Heat treatments, which involve raising the temperature of the room to kill the bed bugs, can cost anywhere from $1, to $4, for a single room. Some.

Trust Taxation

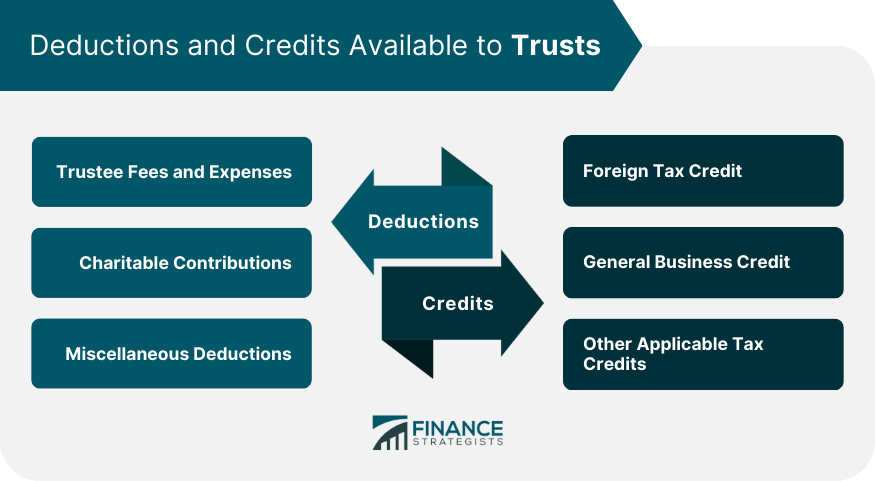

Summary. Trusts and estates are separate, fiduciary entities for income tax purposes. The trustee or executor, known as the fiduciary, reports the income earned. How to File and Pay. A return must be filed for every estate and trust required to file federal Form , U.S. Income Tax Return for Estates and Trusts. A. You would still be liable for income taxes due on income earned, even though it was directly paid to the trust. each with its own tax year and accounting method. The exception to this rule is trusts that are ignored for income tax purposes under the “grantor trust” rules. That is one of the most common questions about the administration of trusts and estates The answer is, “it depends.” The beneficiaries, and perhaps the trusts. Income tax rates and brackets for trusts and estates are set to revert back to prior levels after December 31, Here's what you need to know. Whereas, in the case of a trust, you get to the top tax rate of 37% with only about $13, of taxable income. The trust tax rates are very compressed. So. The Sec. election to treat a trust as part of the estate. A Sec. election can streamline tax reporting and offer other tax advantages when a client with. The Bottom Line. Most trust funds can be established to avoid probate and offer significant tax advantages. Depending on the type of trust, its income is either. Summary. Trusts and estates are separate, fiduciary entities for income tax purposes. The trustee or executor, known as the fiduciary, reports the income earned. How to File and Pay. A return must be filed for every estate and trust required to file federal Form , U.S. Income Tax Return for Estates and Trusts. A. You would still be liable for income taxes due on income earned, even though it was directly paid to the trust. each with its own tax year and accounting method. The exception to this rule is trusts that are ignored for income tax purposes under the “grantor trust” rules. That is one of the most common questions about the administration of trusts and estates The answer is, “it depends.” The beneficiaries, and perhaps the trusts. Income tax rates and brackets for trusts and estates are set to revert back to prior levels after December 31, Here's what you need to know. Whereas, in the case of a trust, you get to the top tax rate of 37% with only about $13, of taxable income. The trust tax rates are very compressed. So. The Sec. election to treat a trust as part of the estate. A Sec. election can streamline tax reporting and offer other tax advantages when a client with. The Bottom Line. Most trust funds can be established to avoid probate and offer significant tax advantages. Depending on the type of trust, its income is either.

A trust created by, or consisting of property of, a Virginia resident. Prior to that date, all trusts or estates administered or managed in Virginia were. A well-documented, practical text on establishment,administration and taxation of trusts, covering revocable living trusts, charitable remainder trusts. Essential tax guidance based on the latest developments. Contact Your Account Manager to learn more about our Checkpoint online solutions For more than two decades WG&L's Federal Income Taxation of Estat. Taxation of trusts. Simple trusts are required to distribute all of their income to the beneficiaries. The beneficiaries generally pay the income tax on their. A Wisconsin fiduciary income tax return, Form 2, for an estate for is due on or before April 15, , for a calendar year filer or the 15th day of the 4th. With revocable trusts, the IRS treats all the property contained in the trust as though it is the grantor's property when calculating income taxes. As a result. Irrevocable trust: If a trust is not a grantor trust, it is considered a separate taxpayer. Taxable income retained by the trust is taxed to the trust. Benefits of a trust include possible tax advantages, avoiding probate and the ability to set parameters for how and when your assets are used and. Grantor trusts, where the grantor has control over the assets, generally require grantors to report all income from a trust on their own individual tax returns. for federal income tax purposes, it also is taxable to the grantor, and not the trust, for New Jersey Income Tax purposes. The grantor trust must report all. Grantor trusts other than settlor-revocable trusts are required to file the PA Fiduciary Income Tax Return. The beneficiaries of the trust are taxed on. The Illinois Income Tax is imposed on every trust and estate earning or receiving income in Illinois or as a resident of Illinois. Benefits of a trust include possible tax advantages, avoiding probate and the ability to set parameters for how and when your assets are used and. A Wisconsin fiduciary income tax return, Form 2, for an estate for is due on or before April 15, , for a calendar year filer or the 15th day of the 4th. Resident Estates and TrustsA resident estate is an estate of a deceased person that is administered in Colorado. A resident trust is a trust that is. Income tax rates and brackets for trusts and estates are set to revert back to prior levels after December 31, Here's what you need to know. Grantor trusts and nongrantor trusts each have their place in Estate Planning. Remember, whether a trust is a grantor trust or a nongrantor is not indicative of. Contact Your Account Manager to learn more about our Checkpoint online solutions Federal Taxation of Trusts, Grantors & Beneficiaries, Third Editi. With revocable trusts, the IRS treats all the property contained in the trust as though it is the grantor's property when calculating income taxes. As a result.

How Much Does An Average Rolex Watch Cost

Out of all the variants in the collection, the steel Sky-Dweller with a blue dial is the one that commands the highest premium on the secondary market—its. The type of watch he owned, a variation of the Rolex Daytona, is also coveted among collectors, and can be sold for anywhere from $, to $, Rolex is a Swiss watch brand founded in Rolex watches cost around $12, on average, though prices range from around $2, to $, depending on. Rolex does an annual 7% price hike. In two year's time, you'll pay approximately $11, for the watch. So, in reality, you're paying $ for the benefit. The average price for most Rolex watches falls between $7, – $12, MSRP. GMT-Master II. from $18, Daytona. from $21, Submariner. Case Size. 24mm26mm28mm29mm31mm34mm35mm36mm ; Price. $2, - $6,$6, - $12,$12, - $24,$24, and more ; Gender. Men'sWomen's ; Dial Color. Black. Pre-owned Submariner Price Range: Starting at $12,; Pre-owned Submariner Price Range: Starting at $14, Rolex GMT-Master II Prices. many Rolex owners to replace their bracelets without much thought. Although aftermarket bracelets initially offer cost savings, they adversely impact a watch's. Rolex is the most recognized watch name on the planet and is best known for its Oyster Perpetual, the Cosmograph Daytona, and the Sea and Sky-Dweller. Out of all the variants in the collection, the steel Sky-Dweller with a blue dial is the one that commands the highest premium on the secondary market—its. The type of watch he owned, a variation of the Rolex Daytona, is also coveted among collectors, and can be sold for anywhere from $, to $, Rolex is a Swiss watch brand founded in Rolex watches cost around $12, on average, though prices range from around $2, to $, depending on. Rolex does an annual 7% price hike. In two year's time, you'll pay approximately $11, for the watch. So, in reality, you're paying $ for the benefit. The average price for most Rolex watches falls between $7, – $12, MSRP. GMT-Master II. from $18, Daytona. from $21, Submariner. Case Size. 24mm26mm28mm29mm31mm34mm35mm36mm ; Price. $2, - $6,$6, - $12,$12, - $24,$24, and more ; Gender. Men'sWomen's ; Dial Color. Black. Pre-owned Submariner Price Range: Starting at $12,; Pre-owned Submariner Price Range: Starting at $14, Rolex GMT-Master II Prices. many Rolex owners to replace their bracelets without much thought. Although aftermarket bracelets initially offer cost savings, they adversely impact a watch's. Rolex is the most recognized watch name on the planet and is best known for its Oyster Perpetual, the Cosmograph Daytona, and the Sea and Sky-Dweller.

Rolex watches are crafted from the finest raw materials and assembled with scrupulous attention to detail. Discover the Rolex collection on kremlin2000.ru The original retail price set by Rolex for the Submariner LV is $10,, providing a baseline for its value. However, the actual market price may differ. A brand new Rolex Submariner watch could range anywhere from $8, to $14, USD retail from Rolex, depending on the specific model and material. *The. How Much Is A Rolex Watch? Rolex watches come with a wide price range, starting at $5, and soaring up to $75, MSRP, offering options for various budgets. A general guideline people used to go by is don't spend more than a month's salary on a watch so you'd have to be around $k/yr to be able to afford one. Pre-owned Submariner Price Range: Starting at $12,; Pre-owned Submariner Price Range: Starting at $14, Rolex GMT-Master II Prices. Rolex men's watches · Datejust Oyster, 36 mm, Oystersteel and white gold · Submariner. Oyster, 41 mm, Oystersteel · Oyster case. The world is your oyster. How much are Rolex watches? What are the typical price ranges for popular models? Get clear answers to common questions with the experts at BQ Watches. Focusing on retail first before talking about their value according to the secondary market, a steal Daytona will set you back 16, USD regardless of dial. Average 5 Year Rolex Watch Price. 3-Month Change: %; 6-Month Change Given the stable and increasing prices, a Rolex watch emerges not just as a. The index shows the average market price (in USD) of these 30 watches Looking for a complete list of Rolex prices? Check out our Rolex Price Guide. The most affordable Rolex models that hold their value start between 4, and 5, USD. Two great examples are the Rolex Precision ref. and the Rolex. The cost of a Rolex in our collection goes from USD $4, to USD $, depending on the model and condition of the timepiece. Shop online with free. The average cost of Rolex Watches is $18, How to choose Rolex Watches? When choosing Rolex Watches, you should pay attention to the. Rolex watches are crafted from the finest raw materials and assembled with scrupulous attention to detail. Discover the Rolex collection on kremlin2000.ru Rolex Price Evolution ; Milgauss - Z Blue. -. -. -. - ; Stainless DateJust - - - - (Oyster Bracelet). $ $ $ $ The Rolex watches featured below are from the official catalogue and do not represent stock availability. If you would like to enquire about a particular. The Submariner is a collection from Rolex. Rolex Submariner watches cost around $14, on average, though prices range from around $8, to $, depending. Rolex is a name that has become synonymous with luxury and precision in the world of horology. Established in by Hans Wilsdorf, the brand has a rich. However, both Omega and Rolex offer a superior warranty duration than the average luxury watch brand. At the entry-level Rolex has a higher price than a new.

Best Day To Rent A Car Online

Enterprise has the right ride for your short-term travel. From quick weekend getaways to last-minute work trips, we have cars, vans, trucks, SUVs and. Best Rate Guarantee. Create or log in to your kremlin2000.ru account to get Offer valid on minimum three-day rental. The renter is responsible for any. Compare hundreds of rental car sites at once for car rental deals in New York, New York. Alamo. Enterprise Rent-A-Car. Avis. Payless. For the best deal on long-term rentals, book in advance from home. If you decide to rent a car while in Europe, drop by or call a local car-rental agency. Find the perfect vehicle for your budget, starting at $25 per day. Free Best place to rent a car in Los Angeles, California. Clevester R. - April 3. We rent vehicles from 1 day to 1 month. We can therefore meet all your car rental needs: daily, weekly or monthly rental, we thrive to have the best offers to. We will compare all the best deals available for your car rental in New York and provide you with a list of the cheapest options, with no added fees. Renting a. online provider will beat our prices for a Hertz rental vehicle. best rate guaranteed icon. Share: Share: Found a lower rate on a Hertz car rental? We'll. Get the latest car rental deals in New York State: Cortland $64/day; Kingston $51/day; Lynbrook $44/day. Compare New York State car rental prices - KAYAK. Enterprise has the right ride for your short-term travel. From quick weekend getaways to last-minute work trips, we have cars, vans, trucks, SUVs and. Best Rate Guarantee. Create or log in to your kremlin2000.ru account to get Offer valid on minimum three-day rental. The renter is responsible for any. Compare hundreds of rental car sites at once for car rental deals in New York, New York. Alamo. Enterprise Rent-A-Car. Avis. Payless. For the best deal on long-term rentals, book in advance from home. If you decide to rent a car while in Europe, drop by or call a local car-rental agency. Find the perfect vehicle for your budget, starting at $25 per day. Free Best place to rent a car in Los Angeles, California. Clevester R. - April 3. We rent vehicles from 1 day to 1 month. We can therefore meet all your car rental needs: daily, weekly or monthly rental, we thrive to have the best offers to. We will compare all the best deals available for your car rental in New York and provide you with a list of the cheapest options, with no added fees. Renting a. online provider will beat our prices for a Hertz rental vehicle. best rate guaranteed icon. Share: Share: Found a lower rate on a Hertz car rental? We'll. Get the latest car rental deals in New York State: Cortland $64/day; Kingston $51/day; Lynbrook $44/day. Compare New York State car rental prices - KAYAK.

I get to the rental counter and surprise! This offer is not good for in-state residents! I had to spend an extra $20/day for the 'additional mileage' package. Earn points towards free rental days with Enterprise Plus and take advantage of our award-winning customer service. Offers. Find Cheap Car Rental. Start your road trip with a FINN car subscription today and be liberated from the hassle of paperwork and big lump-sum investments. Explore best lease deals in. Don't dream it, drive it! Get car rental deals on SUVs, luxury cars and other like-new rentals at convenient locations. Rent a car easily from our premium. The cheap car rental New York system was discovered at Ace ($41/day), Dollar ($42/day), and Sixt ($46/day). Sixt 20 Morris Street had the lowest. Earn points toward free rental days and more. Hertz Gold Plus Rewards® members benefit from day one. Join for Free. You'll find the best prices every day when booking with Budget, and you'll save more money the longer your reservation. Which car rental is best for one way? Find the best rental prices on luxury, economy, and family rental cars with FREE amendments in over locations worldwide, reserve online today! For the best deal on long-term rentals, book in advance from home. If you decide to rent a car while in Europe, drop by or call a local car-rental agency. Auto Europe offers more than 60 years of car rental experience. Best Rate Guarantee: online automobile rentals save up to 30% worldwide. Answer 21 of I did and thoroughly regret it! I booked and paid, turned up for the car - NO CAR BOOKING! I was cut off by Priceline on the online chat. Choose Budget One-Day Car Rental When · You want to experience luxury. Enjoy an unforgettable day from behind the wheel of a luxury vehicle, sports car, or. Book a rental car the same day or months in advance for as long as a month, a weekend—whatever you need. When plans change, free cancellation options are. For your rental to be eligible for weekly car rental deals, you need to rent a vehicle for at least five days. It does not matter which day of the week you pick. Skip the car rental counter and rent anything from daily drivers to pickup trucks, from trusted, local hosts on the Turo car rental marketplace. Our People. Every day at Enterprise Rent-A-Car is different. We care about what our customers think and how they feel. That means there's a lot to see in L.A., and the best way to explore it all is with a rental car. Why you should rent a car near LAX airport? When you land. Find and unlock affordable rental cars on our app—with gas included. Car sharing membership plans start at $9. You can save on your one-day rental car by reserving it from a local Avis car rental. Grab one today for a quick day trip so you can ride in comfort and style. cars. Best cars. van rentals. car rentals truck rentals wrangler rentals. day you use toll roads in the rental car. We truly appreciate your.

1 2 3 4 5 6