kremlin2000.ru

News

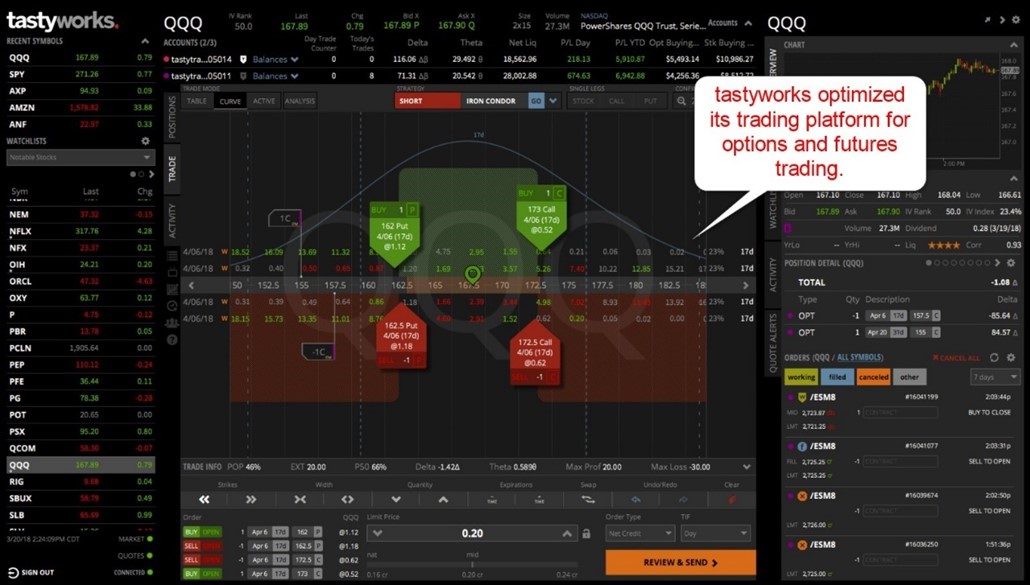

Tastyworks Day Trading

Yes. You can trade options everyday. There is no limit on number of options trades you can take per day. As long as you have the money, you. Totally free access to multiple traders in a 8 hour a day live streaming show. You no longer need to pay for any trading education! Day trades occur when there is a “change in direction” after opening and closing a position in one trading day. A change in direction means entering a sell to. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. I also have a commission based. tastytrade Inc. (previously known as tastyworks Inc.) The broker for traders who deserve better. Questions? Email us at: [email protected] tastytrade: Invest & Trade 4+ · Trade Options, Futures, Stocks · tastyworks · iPad Screenshots · Additional Screenshots · Description · What's New · Ratings and. If you buy ten options and sell them the same day, you have to wait until the money clears (next day) before you can use those funds again. You should consider the following points before engaging in a day-trading strategy. For purposes of this notice, a "day-trading strategy" means an overall. Starting Day Trade Buying Power is your account's maintenance excess at the close of the previous day. Yes. You can trade options everyday. There is no limit on number of options trades you can take per day. As long as you have the money, you. Totally free access to multiple traders in a 8 hour a day live streaming show. You no longer need to pay for any trading education! Day trades occur when there is a “change in direction” after opening and closing a position in one trading day. A change in direction means entering a sell to. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. I also have a commission based. tastytrade Inc. (previously known as tastyworks Inc.) The broker for traders who deserve better. Questions? Email us at: [email protected] tastytrade: Invest & Trade 4+ · Trade Options, Futures, Stocks · tastyworks · iPad Screenshots · Additional Screenshots · Description · What's New · Ratings and. If you buy ten options and sell them the same day, you have to wait until the money clears (next day) before you can use those funds again. You should consider the following points before engaging in a day-trading strategy. For purposes of this notice, a "day-trading strategy" means an overall. Starting Day Trade Buying Power is your account's maintenance excess at the close of the previous day.

Open an account now. 1. Tastyworks Day Trade Counter fractional shares, which can be a problem for small traders. For Volume Use youll see. A cash account doesn't limit you to the pattern day trading rule. TastyWorks Stock Price and Symbol: Are They Publicly Traded? dough trading platform is moving to tastyworks. Transfer your dough account to tastyworks before October 29 for free and keep your zero-commissions* privileges. This group is formed out of frustration in TastyTrade Group Discussion that disallows discussion on /DTE, day trading, swing tranding. The day trade requirements for a given day are determined by looking at the high water mark of the day trade requirements based on the opening trade(s) of day. Useful Links · Background · Market Access for Live Trading · Market Data and Software Costs · User Interface and Technology · Day Trading Platform Tools, Live. TastyWorks is a fun broker to trade Options with and you have the ability to trade equities beyond the US markets. They are reliable with a mobile and online. Pattern Day Trading Rules (PDT). Margin accounts are flagged as PDT when was formerly known as tastyworks, Inc. © – tastytrade, Inc. Tastyworks offers free online trading and $1 per options contract for stocks and etfs traders, are a big draw for day traders. Tastytrade nails its specialty. Day trade calls are generated when a margin account exceeds its starting day trade buying power. Day trade calls are different from Equity Maintenance calls. Furthermore, cryptocurrencies do not have a typical "day" trading session similar to equities or futures. tastytrade, Inc. was formerly known as tastyworks. Tastytrade operates in the United States and must comply with the pattern day-trading rule. This rule requires any account classified as a PDT account to hold. Stocks. Options. Futures. More. Get the trading platform that lets you take control of your investing, from the broker that does things better: tastytrade. Notes, Tags and Trade Plans: Easily manage per-day, per-trade notes and even add plans to analyze your rules and mistakes. TradesViz's trade and import. Open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. From the brains that brought you. All day orders will be typically cancelled at the end of the trading day pm CT or when applicable to pm CT for certain option symbols including index. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade. Minimum requirements to trade futures at tastyworks. Pattern Day Trading Rules (PDT) · Supported Countries for International. set by tastyworks for the particular Futures contract held at the start of the following trade day. You acknowledge that tastyworks reserves the right to.

What Is A Vwap In Trading

VWAP is a trading algorithm based on a pre-computed schedule that is used in the execution of a bigger order to minimize the impact on the market price. Calculation. There are five steps in calculating VWAP: Calculate the Typical Price for the period. Multiply the Typical Price by the period Volume. Create a. VWAP stands for volume weighted average price, a trading benchmark that is often used by passive investors. It reflects the ratio of an asset's price to its. Traders use volume-weighted average price tool to find the right entry and exit points in the market. Get detailed information on VWAP at Angel One. trading—VWAP. Learn how VWAP can be used in combination with other Volume weighted average price (VWAP) is a moving average that tracks the price. Volume-Weighted Average Price (VWAP) is often used as a trading benchmark by traders, pension funds, mutual funds and market makers. It can allow traders to get. A stock's volume-weighted average price (VWAP) is its average price during a trading day, adjusted for volume. It's similar to a moving average used in. VWAP is a currency pair's average trading price based on the currency pair's trading volume and prices at specific time periods. The Volume Weighted Average Price (VWAP) is, as the name suggests, is the average price of a stock weighted by the total trading volume. The VWAP is used. VWAP is a trading algorithm based on a pre-computed schedule that is used in the execution of a bigger order to minimize the impact on the market price. Calculation. There are five steps in calculating VWAP: Calculate the Typical Price for the period. Multiply the Typical Price by the period Volume. Create a. VWAP stands for volume weighted average price, a trading benchmark that is often used by passive investors. It reflects the ratio of an asset's price to its. Traders use volume-weighted average price tool to find the right entry and exit points in the market. Get detailed information on VWAP at Angel One. trading—VWAP. Learn how VWAP can be used in combination with other Volume weighted average price (VWAP) is a moving average that tracks the price. Volume-Weighted Average Price (VWAP) is often used as a trading benchmark by traders, pension funds, mutual funds and market makers. It can allow traders to get. A stock's volume-weighted average price (VWAP) is its average price during a trading day, adjusted for volume. It's similar to a moving average used in. VWAP is a currency pair's average trading price based on the currency pair's trading volume and prices at specific time periods. The Volume Weighted Average Price (VWAP) is, as the name suggests, is the average price of a stock weighted by the total trading volume. The VWAP is used.

Volume-weighted average price [VWAP] is a technical indicator that calculates and displays a market's average transaction price for however long it's. VWAP is a short-term trend indicator used on intraday charts. It measures the average price of a stock weighted by trading volume and price, and shows up as a. Volume Weighted Average Price. Volume Weighted Average Price. Volume Weighted Average Price is equal to the sum of the volume of every transaction. The Volume-Weighted Average Price (VWAP) is calculated using the following formula: Please read the NFA booklet Trading Forex: What Investors Need to Know. VWAP is a popular technical indicator used by traders and investors to gauge the average price at which a security has traded throughout the day. Volume Weighted Average Price (VWAP) is a technical indicator used by traders to gauge the average price at which a security has traded throughout the day. The VWAP intraday strategy for trading tells a short-term trader whether or not a stock is bearish or bullish. If a stock touches VWAP and falls below it, this. VWAP is a technical indicator that shows the average trading price of a security over a given trading session, weighted by total trading volume. The Volume Weighted Average Price (VWAP) is used to reveal the true average price that a stock was traded at during any given point in the day. The formula is. Trading Strategy with VWAP. Besides showing you the points of interest, you can look at the volume-weighted average price to find the predominant trend of the. The Volume Weighted Average Price indicator (VWAP) shows the intraday average traded price of an instrument based on both volume and price. Volume-weighted average price (VWAP) is the ratio of the value of a security or financial asset traded to the total volume of transactions during a trading. Volume-Weighted Average Price(VWAP) measures the average asset price weighted by the total trading volume. VMAP is usually used on intraday charts. Key Points - VWAP, the volume-weighted average price indicator, is used to measure the weighted average price by quantity. - The VWAP indicator is usually. The VWAP (Volume Weighted Average Price) is a measure of the price at which the majority of a given day's trading in a given security took place. If you trade stocks and don't yet have the VWAP indicator on your chart, then this post is for you. Read on. The Volume-Weighted Average Price (VWAP) is calculated using the following formula: Please read the NFA booklet Trading Forex: What Investors Need to Know. trading—VWAP. Learn how VWAP can be used in combination with other Volume weighted average price (VWAP) is a moving average that tracks the price. VWAP is a technical analysis indicator used by traders to determine the average price of a stock over a certain period of time. Volume-Weighted Average Price(VWAP) measures the average asset price weighted by the total trading volume. VMAP is usually used on intraday charts.

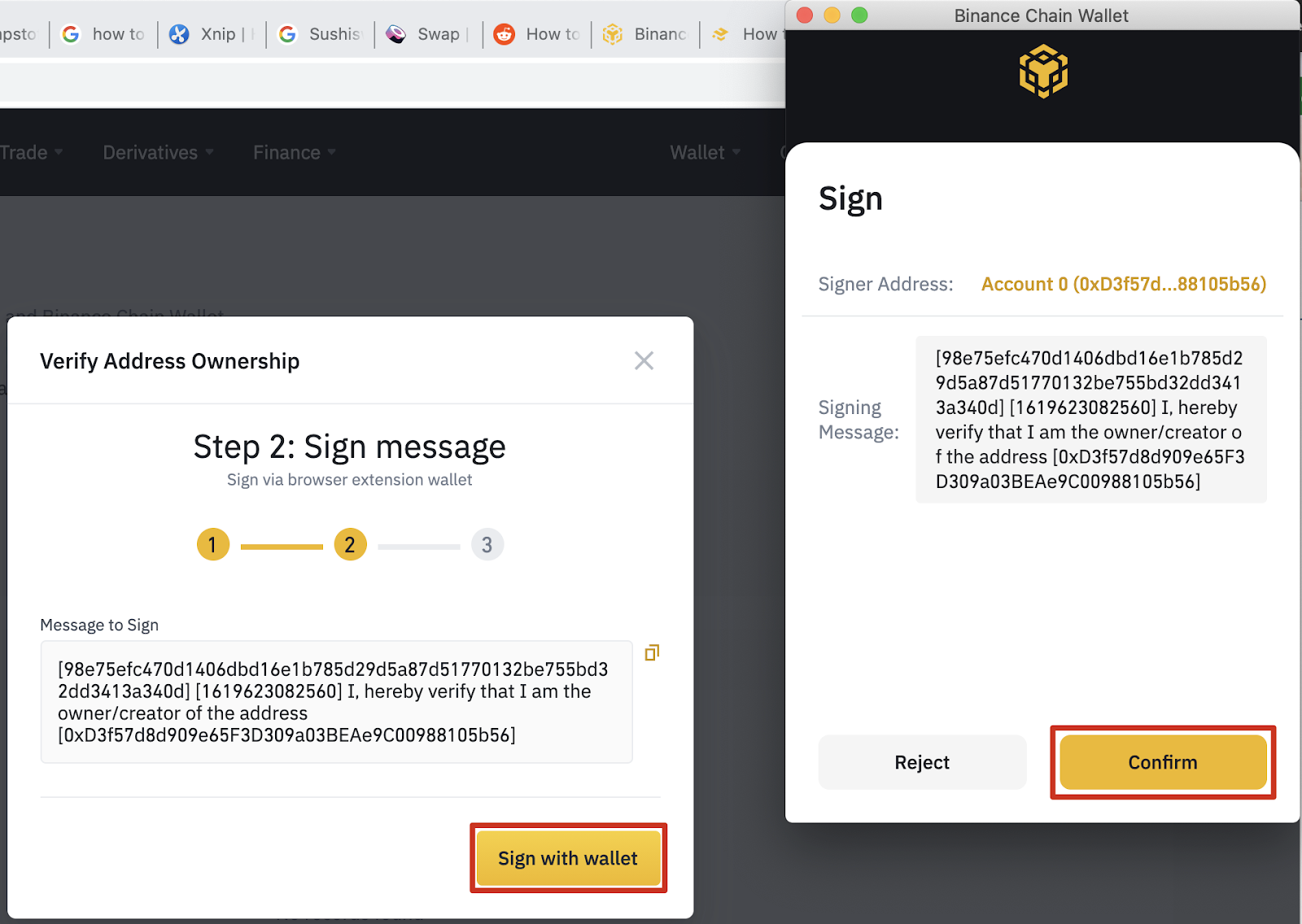

Binance Chain Wallet Download

Easy Binance Smart Chain payments. Easy Binance Smart Chain payments by simply clicking on links or scanning QR-codes. Download now. Web Wallet. Launch now. Download Ownbit wallet to secure your BEP20 assets now! Store BNB and BEP20 tokens in Ownbit cold wallet now. BNB/BEP20 MultiSig Wallet. Download Binance Smart. BSC wallet is a decentralized multi-chain digital asset wallet based on BNB smart chain. It is committed to applying the latest blockchain technology in real. Download Binance Chain Wallet Latest Version APK for Android from APKPure. Binance Chain Wallet & BSC Wallet. Download the Bitget Wallet now to jump start your BNB Chain journey! What is BNB? BNB officially listed on Binance trading platform in July BNB was. BscScan allows you to explore and search the Binance blockchain for transactions, addresses, tokens, prices and other activities taking place on BNB Smart. Binance Mobile and Desktop Downloads - Use our Crypto Trading App for your phone or a desktop application to trade on your Mac or windows machine. Free Binance Smart Chain (BNB) cryptocurrency wallet with 24/7 support. Easily create a Binance Smart Chain address, send, and exchange over + coins and. Binance Web3 wallet is a keyless, seedless, multi-chain, semi-custody wallet designed for DeFi Download for iOS. Get the Binance app from the App Store. Easy Binance Smart Chain payments. Easy Binance Smart Chain payments by simply clicking on links or scanning QR-codes. Download now. Web Wallet. Launch now. Download Ownbit wallet to secure your BEP20 assets now! Store BNB and BEP20 tokens in Ownbit cold wallet now. BNB/BEP20 MultiSig Wallet. Download Binance Smart. BSC wallet is a decentralized multi-chain digital asset wallet based on BNB smart chain. It is committed to applying the latest blockchain technology in real. Download Binance Chain Wallet Latest Version APK for Android from APKPure. Binance Chain Wallet & BSC Wallet. Download the Bitget Wallet now to jump start your BNB Chain journey! What is BNB? BNB officially listed on Binance trading platform in July BNB was. BscScan allows you to explore and search the Binance blockchain for transactions, addresses, tokens, prices and other activities taking place on BNB Smart. Binance Mobile and Desktop Downloads - Use our Crypto Trading App for your phone or a desktop application to trade on your Mac or windows machine. Free Binance Smart Chain (BNB) cryptocurrency wallet with 24/7 support. Easily create a Binance Smart Chain address, send, and exchange over + coins and. Binance Web3 wallet is a keyless, seedless, multi-chain, semi-custody wallet designed for DeFi Download for iOS. Get the Binance app from the App Store.

What is BSC (Binance Smart Chain)? · Why AlphaWallet? · Download BNB Vector Logo · Have a project in mind? The thinnest and most stylish cold wallet in the world. CC EAL5+ certified Secure Element chip. Multiple cryptocurrency support that's constantly updated. Step 1: Download Binance Chain Wallet for Chrome or Firefox · Step 2: Click the installed extension and click 'I own a wallet' · Step 3: Enter your recovery. At tax time, simply download the Koinly tax report for your country and Chain- for example, MetaMask, Binance Chain Wallet or Trust Wallet. We have. Download now and discover why over million users choose Binance to buy crypto, trade over cryptocurrencies, and securely hold their assets. The Binance. Download The Binance Wallet. Binance Wallet Download Binance Extension Wallet is a crypto wallet for Binance Chain as well as Binance Smart Chain. downloaded is the binance official binance wallet (from: Chrome app store extension), anyone knows if it is actually possibile that my keys. Binance Chain Wallet, Trust Wallet, and other compatible crypto wallets. wallets are programs that are downloaded and installed on a smartphone or tablet. BNB Chain is a block chain parallel to the Binance Chain, with the well Download MathWallet with BNB Chain Wallet support. The funds are only. The Binance Chain Wallet extension can be found on Binance's Homepage. From there, please scroll down to the "Download your Crypto Wallet" section and click on. Download our easy to use Smart Chain Wallet today. Send, receive, store and exchange your cryptocurrency within the mobile interface. The Trust Wallet is. Download the BNB Smart Chain (BNB) Wallet from kremlin2000.ru Buy, sell, trade BNB Smart Chain, formerly Binance Smart Chain, is an Ethereum Virtual. To optimally use your BEP20 wallet, BNB, the principal token of the Binance Smart Chain, is necessary. Download Gem Wallet App for iOS or Android. Desktop. You must have the Binance Chain wallet extension installed in your browser. You can download it in the chrome web store. Since they do not need to download the entire Binance Chain network and its transactions, they tend to be less intensive on a user's resources. Finally, when. Install the Binance Smart Chain (BNB Chain) app on your Ledger device · Open Ledger Live and navigate to the My Ledger tab. · Connect and unlock your Ledger. Don't LOVE your wallet? Creating a new wallet with MEW is easy. Download Enkrypt multichain browser wallet. Need help? Use this Enkrypt guide · Download MEW. Download MathWallet with Binance Chain Wallet support. The funds are only accessible to its owners. Send, store and exchange cryptocurrency on your mobile and. Download Fast And Secure BNB Wallet App For Mobile - IOS And Android - And Desktop. Buy, Sell And Swap Bnb And + Cryptos In One Secure Crypto Wallet.

Can Banks Go Bankrupt

Bank managers can take a lot of risk and, if they make profits, they keep the money. If they lose money, the taxpayers pay for the losses. In theory, this moral. Many major banks have proven to be willing to continue doing business with clients even if they have declared bankruptcy while owing them a debt. However, just. Your mortgage is worth money when the bank goes bankrupt, it will be sold to another bank or institution to get cash. The new owner holds your. And I pointed out that the Bank of Canada is now functionally bankrupt – it is losing money every day. This unhappy state of affairs flows from its “. However, FDIC deposit insurance does not protect against the insolvency or bankruptcy of a nonbank company. In such cases, while consumers may. And this decline in asset values relative to liabilities can lead to bank instability through two channels. First, a bank can become fundamentally insolvent if. While it's always alarming to learn of a bank failure, they do occur more frequently than most people assume. According to the FDIC, there have been a total of. bank failures—explained. A bank failure is defined as the closing of a bank by a federal or state banking regulatory agency. This typically happens when a. A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to. Bank managers can take a lot of risk and, if they make profits, they keep the money. If they lose money, the taxpayers pay for the losses. In theory, this moral. Many major banks have proven to be willing to continue doing business with clients even if they have declared bankruptcy while owing them a debt. However, just. Your mortgage is worth money when the bank goes bankrupt, it will be sold to another bank or institution to get cash. The new owner holds your. And I pointed out that the Bank of Canada is now functionally bankrupt – it is losing money every day. This unhappy state of affairs flows from its “. However, FDIC deposit insurance does not protect against the insolvency or bankruptcy of a nonbank company. In such cases, while consumers may. And this decline in asset values relative to liabilities can lead to bank instability through two channels. First, a bank can become fundamentally insolvent if. While it's always alarming to learn of a bank failure, they do occur more frequently than most people assume. According to the FDIC, there have been a total of. bank failures—explained. A bank failure is defined as the closing of a bank by a federal or state banking regulatory agency. This typically happens when a. A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to.

In September of , Lehman Brothers holdings announced a Chapter 11 bankruptcy filing. With $ billion in pre-bankruptcy assets, this was the Titanic of all. The financial crisis showed the damage that the failure of an institution can have on consumers, society and the wider economy. At that time when these. Most institutions use this opportunity to freeze the account, leaving clients without any funds going forward. However, both Bankruptcy and Consumer Proposals. What would happen if one of our banks, credit unions or investment firms went belly up and you had an account at the bankrupt firm? Would you get your money. A bank may become insolvent if it cannot pay its debts as they fall due, even though its assets may be worth more than its liabilities. If you owe money we recommend that you move your money from your account before going bankrupt. Filing a consumer proposal can help you with your bank accounts. This usually happens for one of two reasons: The bank cannot pay its debts as they fall due, even though its assets may be worth more than its liabilities. bank failures—explained. A bank failure is defined as the closing of a bank by a federal or state banking regulatory agency. This typically happens when a. When a bank gives more money to its borrower than it owns in assets, it declares bankruptcy. Despite the legislative restrictions in place in. If a significant percentage of people go bankrupt and fail to pay back the bank, the bank will now be in negative territory. Largest Bank Failures. Failure occurs when a bank can't meet its financial obligations due to assets and cash reserves being nearly depleted. Essentially, the. This makes it unlikely that you would lose money even if your brokerage did go bankrupt. In the unlikely event that your assets did disappear, however, the. A bank run occurs when many customers simultaneously withdraw their money from deposit accounts for fear that the bank may be, or will become, insolvent. On September 18, , JCC declared bankruptcy. Depositors across the country justifiably panicked after seeing such a large bank collapse. Like previous. Will my bank close my account when I go bankrupt? Banks freeze your account as soon as you go bankrupt. Even if you have no debts with them. This lasts a. If you've already been declared bankrupt, you can apply for a new bank or building society account. The bank or building society may ask if you are bankrupt. Will my bank close my account when I go bankrupt? Banks freeze your account as soon as you go bankrupt. Even if you have no debts with them. This lasts a. January 29, , United States American Freedom Mortgage, Chapter 11 bankruptcy and liquidation ; February 21, , Northern Cyprus First Merchant Bank. Many of the small banks had lent large portions of their assets for stock market speculation and were virtually put out of business overnight when the market.

Where To Put Money Instead Of Savings Account

A CD account typically requires a higher balance than savings accounts, and your funds will usually remain on deposit for a fixed period of time. Money market account. Money market accounts are similar to savings accounts but typically earn higher interest rates and require higher minimum balances. Most. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. What happens when I need to access those funds? Once you've hit a certain goal, or need to use the money, you can either visit your nearest branch to withdraw. Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Deposits (cash and cheques); Withdraw money (at ATMs, bank tellers, etc.) One-time purchases (groceries, gas, etc); One-time or. The best bet is Mutual Funds. Keep your funds in various baskets of funds, You will surely reap more benefits than conventional Bank deposits. A savings account · A certificate of deposit (CD), which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings. Money in a savings account is not an investment, it is to have instant access to money. The alternative is to have cash at home, but instant. A CD account typically requires a higher balance than savings accounts, and your funds will usually remain on deposit for a fixed period of time. Money market account. Money market accounts are similar to savings accounts but typically earn higher interest rates and require higher minimum balances. Most. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. What happens when I need to access those funds? Once you've hit a certain goal, or need to use the money, you can either visit your nearest branch to withdraw. Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Deposits (cash and cheques); Withdraw money (at ATMs, bank tellers, etc.) One-time purchases (groceries, gas, etc); One-time or. The best bet is Mutual Funds. Keep your funds in various baskets of funds, You will surely reap more benefits than conventional Bank deposits. A savings account · A certificate of deposit (CD), which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings. Money in a savings account is not an investment, it is to have instant access to money. The alternative is to have cash at home, but instant.

Whether you can deposit cash into an HYSA depends on your provider. Many HYSA are offered by online-only banks, so you may not be able to make cash deposits at. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. The 5 Best Alternatives to Bank Savings Accounts · 1. Higher-Yield Money Market Accounts · 2. Certificates of Deposit (CDs) · 3. Credit Unions and Online Banks · 4. The best place for most people is a money market fund because (a) they have higher yield than nearly all savings accounts and (b) they have potential tax. Instead, put this cash into a savings account that offers more security. For your longer-term goals that allow you to take on more risk put that money in the. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a. A savings account is like a piggy bank. It's a secure bank account meant to hold and protect your money for future use. Key features. Earns interest to help. While saving and investing are similar, they have important differences. · Saving is the act of putting money somewhere safe for use in an emergency or for a. For example, savings accounts do not use checks for payments and may be used for putting money aside to reach a savings goal. A Huntington savings account also. Our Money Market account It also helps prevent savers from spending money on an impulse buy instead of putting it toward their longer-term financial goals. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a. With a savings account, you can maintain your savings in a liquid state—meaning you can access your funds whenever you want—while also putting some space. Saving is a way of storing your money until you need it. Whereas investing is about putting your money to work for you – and with this, comes more risk. One way to grow your money safely is to save it in an interest-bearing account. Banks, credit unions, and other financial institutions offer high-yield savings. The Emergency Savings Account is designed to build healthy saving habits by saving money for a rainy day. Setting up the automatic transfer, direct deposit or. Plus, you can access your funds at any time unlike with certificates of deposit (CDs) that require your money to be untouched for a set timeframe. Additional. interest (annual percentage yield or APY), helping your savings grow (once you hit the minimum deposit) · liquidity, letting you easily access your money with no. Savings accounts and certificates of deposit (CDs) are among the safest ways to protect your money and reach short- and long-term financial goals. Rather than receiving and depositing a check every pay period (or other checks This can be another alternative to sending money to your savings account. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access.

Invest In Medical Technology

Vensana℠ is actively investing in development and commercial stage companies across the medtech sector, including medical devices, diagnostics and data science. The global medical technology industry's market size was worth around billion euros in Established centers of this industry include the United States. This course will be useful for students interested in careers in the life science and healthcare services sectors, as well as healthcare consulting, investment. Fueled by innovation at the intersection of biology and technology, we're developing the next generation of smarter, less invasive, more personalized treatments. Prior Investments. MTD. Medical Technology and Devices (MTD) is the globally recognized leader in the diabetes management and self-care devices markets. send. is on track to set the record for deals of this size within the sector. 89%. of US VC funds with a healthcare focus have hit fundraising targets in the. Learn how MedTech companies can attract venture capital and private equity funding, and explore MedTech VC and PE investment trends. Endeavour Vision is a leading private equity firm investing in growth-stage medtech and digital health companies. We invest in medical innovation that provides. We've compiled a list of the top Medical Devices investors. The goal is to help Founders find the best investors to target and get introduced to. Vensana℠ is actively investing in development and commercial stage companies across the medtech sector, including medical devices, diagnostics and data science. The global medical technology industry's market size was worth around billion euros in Established centers of this industry include the United States. This course will be useful for students interested in careers in the life science and healthcare services sectors, as well as healthcare consulting, investment. Fueled by innovation at the intersection of biology and technology, we're developing the next generation of smarter, less invasive, more personalized treatments. Prior Investments. MTD. Medical Technology and Devices (MTD) is the globally recognized leader in the diabetes management and self-care devices markets. send. is on track to set the record for deals of this size within the sector. 89%. of US VC funds with a healthcare focus have hit fundraising targets in the. Learn how MedTech companies can attract venture capital and private equity funding, and explore MedTech VC and PE investment trends. Endeavour Vision is a leading private equity firm investing in growth-stage medtech and digital health companies. We invest in medical innovation that provides. We've compiled a list of the top Medical Devices investors. The goal is to help Founders find the best investors to target and get introduced to.

Stryker, SYK, Medical Devices ; Zimmer Biomet Holdings, ZBH, Medical Devices ; Coloplast, CLPBY, Medical Instruments and Supplies ; West Pharmaceutical Services. Top Performing Companies ; SRTS Sensus Healthcare, Inc. , , +% ; INGN Inogen, Inc. , , +%. AdvaMed is the world's largest medical technology association representing device, diagnostics and digital technology companies. MedTech Innovator is the world's largest accelerator for medical device, digital health, and diagnostic companies. Our mission is to improve the lives of. There are many great medical device stocks for investors to consider. Five of the best picks right now are Abbott Laboratories (ABT %), InMode (INMD %). The European trade association representing the medical technology industries, including medical devices, in vitro diagnostics and digital health. For More Information. Please contact a member of the medical technology investment banking team. Find a banker. Finance, Funding, Investment, Merger and Acquisition news and information from the medtech industry. The latest finance, investment, funding and M&A updates. With the medtech industry predicted to generate over half-a-trillion dollars in revenue in , medical technology companies as a whole show no signs of. Our new report explores medtech industry insights on financing, supply chain and other key topics for medtech company leaders. Learn more. Compared to several other industries including automotive, defense, and telecommunications, the medical device industry invests a higher percentage of yearly. Changes in payment policy from both government and commercial payers are driving investment in healthcare, for example, telemedicine. It was rapidly apparent. cultivate(MD) | Medical Device Venture Capital Fund cultivateMD is a unique medical device venture capital fund. We are unique because we leverage our many. The study found that venture capital investments in the sector were declining as investors shied away from unproven early-stage technologies, regulatory and. Portfolio Companies · Koelis · Radiaction · Channel Medsystems · Route 92 Medical · Materna Medical · Monteris Medical. The global medical technology industry's market size was worth around billion euros in Established centers of this industry include the United States. COVID is accelerating innovations in areas where the MedTech sector was already investing. · New technologies are changing product development, manufacturing. 16 Best Digital Health Investors in · a16z · 7wireVentures · National Science Foundation · Rock Health · Health Ventures · Virtue VC · Lerer Hippeau. The Raymond James Med Tech team, located in both the U.S. and Europe, stays agile to serve companies developing innovative products and technologies for the.

Fibonacci Sequence For Stocks

A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of %, %, %, 50%, %, and %. Chart: Fibonacci. In a strong trend, the maximum retracement for an equity/index is usually % or %. In a weaker trend, one can generally expect the stock to retrace no. Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, and place stop-loss orders. There are five key Fib retracement levels that traders pay attention to: the , , , , and You can use the Fibonacci retracement tool on. Fibonacci retracements can be used to place entry orders, determine stop-loss levels, or set price targets. For example, a trader may see a stock moving higher. Fibonacci levels are then automatically calculated applying the ratios to the value from the plotted high to the plotted low (EG: $25 to $35 = $10 x Fibonacci. Fibonacci retracement is a technical analysis term referring to support or resistance areas that is used by both active and long-term traders. You see fibonacci retracements in speculative stocks. On the way down from the absolute top, the stock tends to retrace 38%, then do a reversal, then retrace. Fibonacci retracements are a popular technical analysis tool that help traders to identify future price movements. Learn more about Fibonacci trading. A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of %, %, %, 50%, %, and %. Chart: Fibonacci. In a strong trend, the maximum retracement for an equity/index is usually % or %. In a weaker trend, one can generally expect the stock to retrace no. Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, and place stop-loss orders. There are five key Fib retracement levels that traders pay attention to: the , , , , and You can use the Fibonacci retracement tool on. Fibonacci retracements can be used to place entry orders, determine stop-loss levels, or set price targets. For example, a trader may see a stock moving higher. Fibonacci levels are then automatically calculated applying the ratios to the value from the plotted high to the plotted low (EG: $25 to $35 = $10 x Fibonacci. Fibonacci retracement is a technical analysis term referring to support or resistance areas that is used by both active and long-term traders. You see fibonacci retracements in speculative stocks. On the way down from the absolute top, the stock tends to retrace 38%, then do a reversal, then retrace. Fibonacci retracements are a popular technical analysis tool that help traders to identify future price movements. Learn more about Fibonacci trading.

Fibonacci retracements are a set of ratios, defined by the mathematically important Fibonacci sequence, that allow traders to identify key levels of support. markets are influenced by human behavior, which is a part of nature, patterns and ratios based on the Fibonacci sequence can manifest in market price movements. The Fibonacci “ratios” are %, %, 50%, %, and %. These ratios show the mathematical relationship between the number sequences and are important. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers. Using Fibonacci retracement levels can help traders identify support and resistance price levels in stocks. Traders can use Fibonacci levels to make informed decisions about entering or exiting trades, setting stop-loss orders, and taking profits. Fibonacci retracement levels are horizontal lines that indicate the possible support and resistance levels where price could potentially reverse direction. Fibonacci works in the stock market because stock market never goes up in a straight line, it always has certain bumps along the way (like small. Fibonacci retracement levels are lines that run horizontally along a chart and can imply potential support and resistance levels where a price reversal is. Traders can use Fibonacci retracement levels to determine where to place orders to enter and exit. For example, if a trader believes that the price of an. Fibonacci retracements are levels (%, %, and %) upto which a stock can retrace before it resumes the original directional move. At the Fibonacci. Fibonacci calculator for generating Stock Analysis · Unlock Company Statistics · Top Stocks · Top Dividend Stocks · Top Gold ETFs · InvestingPro. From forex traders to institutions, Fibonacci is a mainstay of market analysis, and an important tool when trading or investing in stocks. The Fibonacci sequence describes a list of numbers where each one equals the sum of the two preceding numbers, carrying on to infinity. Fibonacci trading is a popular technique used by traders to predict price movements in financial markets. This strategy is based on the mathematical. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels. It is named after the Fibonacci sequence of. Fibonacci Numbers are the numbers found in an integer sequence referred to as the Fibonacci sequence. The sequence is a series of numbers characterized by the. No#1 Fibonacci calculator in play store. Now you can calculate Fibonacci Retracements and Projections in few clicks. A Fibonacci retracement is a popular. In technical stock trading, these lines are set at %, % and %. It is worth noting that even these values form a Fibonacci sequence. While it is not. When forecasting retracement levels, technicians often refer to a series of magic numbers that may help make trading decisions. The Fibonacci sequence is one of.

What Are The Current Home Loan Interest Rates

A Homebuyers Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, A Jumbo Homebuyers Choice loan of. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. Mortgage rates as of September 5, ; % · % · % · % ; $1, · $1, · $1, · $1, Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $67 ; year fixed, % (%), $ ; year fixed, % . Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Current Rates: Mortgage Purchase Rates, Mortgage Refi Rates, Vehicle Loans Rates, Personal Loans Rates, Home Equity Rates, Student Loans Rates, Credit Cards. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. A Homebuyers Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, A Jumbo Homebuyers Choice loan of. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. Mortgage rates as of September 5, ; % · % · % · % ; $1, · $1, · $1, · $1, Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $67 ; year fixed, % (%), $ ; year fixed, % . Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Current Rates: Mortgage Purchase Rates, Mortgage Refi Rates, Vehicle Loans Rates, Personal Loans Rates, Home Equity Rates, Student Loans Rates, Credit Cards. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals.

See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. See how your credit score, loan type, home price, and down payment amount can affect your rate. House price. $. Down payment. %. $. Loan amount $, Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % ; % · % APR · % ; % · % APR · % ; % · % APR. National year fixed mortgage rates remain stable at %. The current average year fixed mortgage rate remained stable at % on Sunday. Home equity loans ; Home equity line of credit · %, % Variable ; year fixed home equity loan · % · %. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. For today, Monday, September 09, , the current average interest rate for a year fixed mortgage is %, falling 5 basis points over the last week. If. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. At a % initial interest rate, the APR for this loan type is %, subject to increase. Based on current market conditions, the monthly payment schedule. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · View More Rates ; District Lending. NMLS # · % · $1, /mo · % ; Choicelend Mortgage. NMLS # · % · $1, /mo · % ; Direct Home Lending. Current Mortgage Purchase Rates ; Yr Fixed Purchase · %, % ; Yr Fixed Purchase · %, % ; Yr Zero Down · %, % ; Yr JUMBO Fixed. Adjustable-Rate Mortgage[2], as low as % (% APR) · Home Equity Line of Credit[3], as low as % (% APR) · Investment Property Loans, as low as. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, mortgage rates, let's start by clarifying what they are. Mortgage rates refer to the current interest rates that lenders offer on mortgage loans. Rates can.

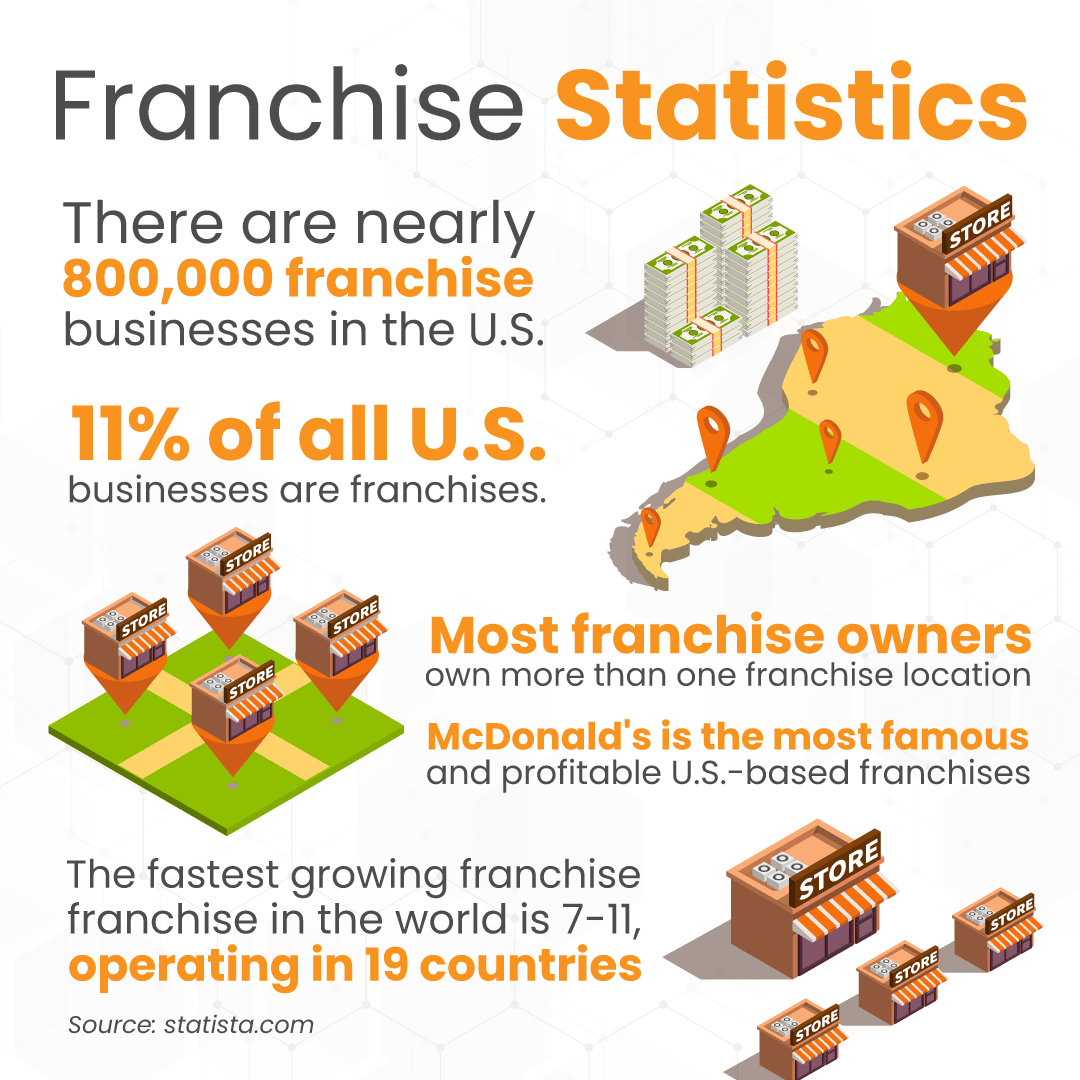

What Is The Benefit Of A Franchise

The Benefits of Franchising - Capital - Motivated and Effective Management - Fewer Employees - Speed of Growth - Limited Risks and Liability - Advertising. Advantages of Owning a Franchise · Established success. An existing franchise already developed its success, so a new franchisee can use these established. The main benefit of becoming a franchisee is that the business will have an established product or service. In franchising, someone has already done the work. CEO at Hometown Restoration & Plumbing · Lower Risks. Most business experts agree that a franchise operation has a lower risk of failure than an. 27 Advantages and Disadvantages of Franchising · Established Brand Recognition · Low-Risk Entry · Access to Proven Business Model · Training and Support · Bulk. The risk of business failure is reduced by franchising. Your business is based on a proven idea. You can check how successful other franchises are before. Purchasing a franchise comes with less risk than establishing a brand-new business. You can study the experience of an existing franchise network and learn from. Top 10 Surprise Benefits of Becoming a Franchisee · Proven Business Model · Brand Recognition · Training and Support · Purchasing Power · Marketing and Advertising. Franchising provides benefits for both seller and buyer. For franchisors, the primary benefit is the ability to use other people's money to expand the brand. The Benefits of Franchising - Capital - Motivated and Effective Management - Fewer Employees - Speed of Growth - Limited Risks and Liability - Advertising. Advantages of Owning a Franchise · Established success. An existing franchise already developed its success, so a new franchisee can use these established. The main benefit of becoming a franchisee is that the business will have an established product or service. In franchising, someone has already done the work. CEO at Hometown Restoration & Plumbing · Lower Risks. Most business experts agree that a franchise operation has a lower risk of failure than an. 27 Advantages and Disadvantages of Franchising · Established Brand Recognition · Low-Risk Entry · Access to Proven Business Model · Training and Support · Bulk. The risk of business failure is reduced by franchising. Your business is based on a proven idea. You can check how successful other franchises are before. Purchasing a franchise comes with less risk than establishing a brand-new business. You can study the experience of an existing franchise network and learn from. Top 10 Surprise Benefits of Becoming a Franchisee · Proven Business Model · Brand Recognition · Training and Support · Purchasing Power · Marketing and Advertising. Franchising provides benefits for both seller and buyer. For franchisors, the primary benefit is the ability to use other people's money to expand the brand.

Learn how investing in a franchise can benefit you. · Owning a Franchise · Expand a Business Model · Build on Your Experience · Start with the Best · Enjoy a Lower. Franchisors that purchase products and services for their franchise network can often negotiate volume discounts and/or rebates from vendors and suppliers. Working for a franchise is an excellent way to earn some extra money and enjoy some benefits, like health insurance, (k) savings, and flexibility. Advantages of Franchising · 1. Capital Preservation · 2. Return on Investment · 3. Risk Reduction · 4. Limited Contingent Liability · 5. Speed of Growth · 6. One of the benefits of franchising is that it allows your company to expand faster. As the franchisor, you can focus on developing new products and services. Benefits of opening a franchise · Franchises have access to proper training. · Franchises receive marketing help. · Franchises have the support of a big company. The benefits of owning a home service franchise · 1. Start a business you can grow quickly · 2. Develop a strong network personal relationships · 3. Spread the. A franchise is a business whereby the owner licenses its operations—along with its products, branding, and knowledge—in exchange for a franchise fee. A. 7 Benefits of Franchising · Low Starting Costs: Becoming a franchisee involves paying starting costs like purchasing property and equipment up front. Franchisee membership benefits include close access to franchisors and suppliers, business discounts and special offers, and gaining franchise business. 20 benefits of owning a franchise · 1. You are on your own, but not alone · 2. Less risks · 3. Faster launch · 4. Easier access to funds · 5. Help identifying. The advantages and disadvantages of franchising include increased brand recognition, business expansion, and supply chain economies of scale. Learn more. Networking opportunities with fellow franchisees; Continuous research and development; Territorial protection; Structured growth pathways; Streamlined supply. Benefits for the Franchisor. As noted above, franchisors get paid for their ideas, expertise, and assistance. The payments typically include a lump-sum. The time to invest in a franchise really depends on the individual. Franchising comes with a built-in fan base, name-brand recognition, and the chance to be. Franchising your business can be a cost-effective way to grow your business. You will not have to cover the cost of investing in new premises or staff. What Are the Disadvantages of Operating a Franchise to the Franchisee? · 1. Initial Costs · 2. Having to Rely on Preset Supply Chain Setup · 3. Lack of Control. Brand Recognition: Perhaps one of the most valuable benefits you'll gain from converting to a franchise system is operating under a recognized and trusted brand. Brand Recognition: Perhaps one of the most valuable benefits you'll gain from converting to a franchise system is operating under a recognized and trusted brand. There are many advantages of franchising as a form of business. It is a relatively low-cost way to start a business. Franchises typically have.

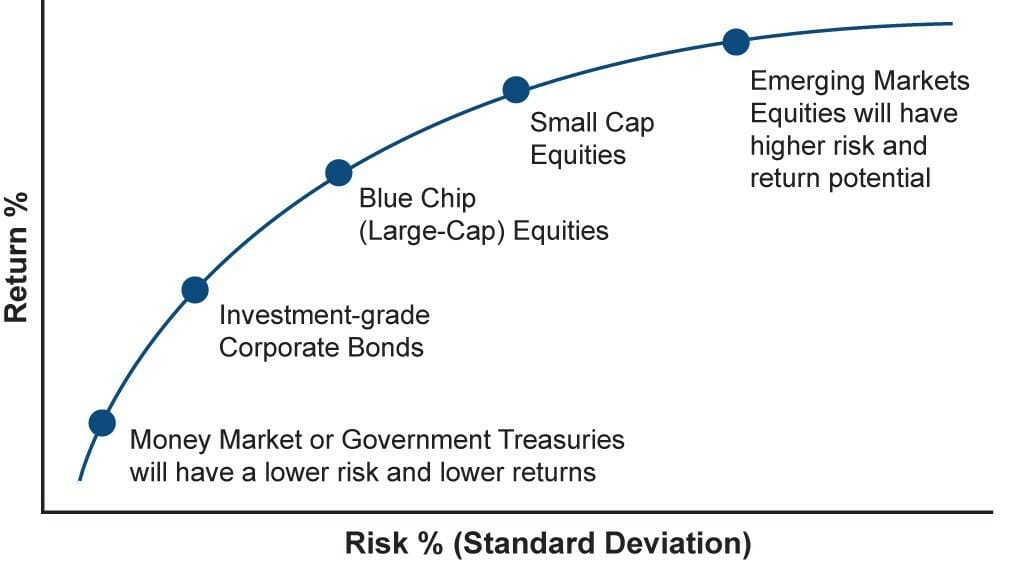

Equity Risk Premia

Worldwide Implied Equity Market Risk Premia · From · Feb 20, · To · Jul 31, The third method of calculating the equity risk premium is to estimate the implied equity rate of return embedded in the current market price, given the. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds—that is, by. Short-horizon equity risk premia: Large company stock total returns minus U.S. Treasury bill total returns.1, 2. Mid-cap equity size premia: Returns in excess. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds—that is, by. Use of Market Risk Premium. As stated above, the market risk premium is part of the Capital Asset Pricing Model. In the CAPM, the return of an asset is the risk. In the equity market, it is the equity risk premium, the price of risk for investing in equities as a class. As you can see. Equity risk premium is the amount by which the total return of a stock market index exceeds that of government bonds. The equity risk premium is equal to the difference between equity returns and returns from government bonds. It is equal to around 5% to 8% in the United States. Worldwide Implied Equity Market Risk Premia · From · Feb 20, · To · Jul 31, The third method of calculating the equity risk premium is to estimate the implied equity rate of return embedded in the current market price, given the. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds—that is, by. Short-horizon equity risk premia: Large company stock total returns minus U.S. Treasury bill total returns.1, 2. Mid-cap equity size premia: Returns in excess. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds—that is, by. Use of Market Risk Premium. As stated above, the market risk premium is part of the Capital Asset Pricing Model. In the CAPM, the return of an asset is the risk. In the equity market, it is the equity risk premium, the price of risk for investing in equities as a class. As you can see. Equity risk premium is the amount by which the total return of a stock market index exceeds that of government bonds. The equity risk premium is equal to the difference between equity returns and returns from government bonds. It is equal to around 5% to 8% in the United States.

An overview of StarMine Equity Risk Premium Model. The StarMine Equity Risk Premium (ERP) model estimates the long-term equity market return and excess return. Equity risk premium is a crucial concept for investors to understand as it can help them make informed investment decisions. Defined as the excess return. Equity risk premium is the difference between returns on equity/individual stock and the risk-free rate of return. Worldwide Implied Equity Market Risk Premia · Italy · Japan · South Korea · Mexico · Malaysia · Netherlands. Equity risk premiums (ERP) represent the price of risk in the equity market, rising as investors perceive more risk, and falling when they. Equity risk premiums (ERP) represent the price of risk in the equity market, rising as investors perceive more risk, and falling when they see less. We can measure the reward for risk that they have received in the past by comparing the return on equities with the return from risk free investments. The. Equity risk premium is a crucial concept for investors to understand as it can help them make informed investment decisions. Defined as the excess return. While the market risk premium represents excess returns on a macro level, an individual stock, fund or strategy also carries a risk premium. capital asset. The implied equity risk premium is the difference between the market return and risk-free rate. The market return has been calculated using the growth rate. In the equity market, it is the equity risk premium, the price of risk for investing in equities as a class. As you can see. Use of Market Risk Premium. As stated above, the market risk premium is part of the Capital Asset Pricing Model. In the CAPM, the return of an asset is the risk. An equivalent definition of a risk premium is: the expected excess return on a security or portfolio, where excess return is the difference between an actual. The high historical equity risk premium is especially intriguing compared to the very low historical rate of return on Treasury securities. This seems to imply. The most common factor is the risk premium associated with equity market exposure, which greatly influences the returns of most long-only equity investments. The equity risk premium is the extra return that investors expect to receive for taking on the higher risk of investing in the stock market compared to risk-. A market risk premium is the expected return on an index or portfolio, while an equity risk premium is a return from just stocks. An equity risk premium is. Both of them have primarily focused on equity markets as the equity risk premium is the most prominent source of investment returns and has captured most of. Each MSCI Risk Premia Index is derived from the equity universe of a traditional market cap weighted MSCI “parent index”. Risk Premia Indices in the Asset. It contains their major research articles on the equity risk premium and new contributions on measuring, forecasting, and timing stock market returns, together.

1 2 3 4 5 6